Schlüsselkomponenten der Long-Call-Option

Long-Call vs. andere Strategien

So verwendet man die Long-Call-Option

So steigert man seine Erfolgschancen

Eine Long-Call-Option bringt Investoren einen Gewinn nach einem Anstieg des Kurses eines Vermögenswertes bei minimalem Risiko. In diesem Artikel erklären wir Ihnen die Grundlagen eines Long-Calls, wie man damit handelt, seine Vor- und Nachteile und wie ein Investor mit diesem Instrument die Rentabilität steigern kann.

Eine Call-Option ist ein Finanzkontrakt, der bei Ausführung dem Investor oder Inhaber das Recht, aber nicht die Verpflichtung gibt, ein Asset zu einem vorab festgelegten zukünftigen Preis oder dem Ausübungspreis innerhalb eines bestimmten Zeitraums zu kaufen. Die zugrundeliegenden Assets können dabei vielfältig sein, einschließlich Aktien, Rohstoffe, Anleihen, Währungen, Indizes und andere. Im Gegensatz zu normalen Aktien, bei denen ein Investor den vollen Betrag im Voraus zahlen muss, erfordert eine Call-Option nur eine geringe Anfangszahlung. Wenn Sie beispielsweise 100 Aktien eines Unternehmens zu je 50 € kaufen möchten, müssten Sie dafür 5.000 € zahlen. Im Gegensatz dazu erfordert der Kauf einer Call-Option nur einen kleinen Bruchteil des zugrundeliegenden Wertes, bekannt als Prämie. Wenn die Prämie für eine Call-Option auf dieselbe Aktie 2 € pro Aktie beträgt, zahlen Sie 200 € für das Recht, 100 Aktien zum Ausführungspreis zu kaufen. Dieser Anfangsbetrag geht an den Verkäufer der Call-Option. Anschließend ist der Verkäufer verpflichtet zu liefern, wenn der Käufer es verlangt. Diese Strategie wird Short-Call-Option genannt. Beachten Sie auch, dass beide Parteien den Vertrag kündigen können. Eine Long-Call-Option bezieht sich explizit auf die Position des Käufers der Call-Option. Wenn Investoren eine Call-Option kaufen, wird das als "Long"-Position bezeichnet. Dies ist eine bullische Strategie, da der Käufer profitiert, wenn der Kurs des zugrundeliegenden Vermögenswerts über den Ausführungspreis plus die gezahlte Prämie steigt.Was ist die Long-Call-Option?

Die Schlüsselaspekte eines Long-Calls sind: Weitere wichtige Konzepte im Zusammenhang mit einer Long-Call-Option:Schlüsselkomponenten der Long-Call-Option

Hebel. Ein Vorteil von Call-Optionen ist, dass sie es Investoren ermöglichen, große Vermögenswerte mit nur geringem Startkapital zu kontrollieren, was sie angesichts des Potenzials für große Gewinne durch Hebeleffekte lukrativ macht. Begrenztes Risiko. Die Call-Option besitzt ein definiertes Risiko-Rendite-Verhältnis, welches den Käufern hilft, die Verlustgefahr zu kontrollieren. Flexibilität. Im Optionshandel sind Investoren in der Lage, verschiedene Ausführungspreis für den Vertrag auszuwählen. So kann ein Investor seine Strategie jederzeit anhand der Marktlage ausrichten. Gewinnpotenzial. Wenn ein Investor eine korrekte Entscheidung getroffen hat, kann er signifikante Gewinne erzielen, insbesondere bei einer hohen Volatilität, die zur erheblichen Aufwertung des zugrundeliegenden Assets führt.Vorteile

In einigen Fällen kann der Vertrag zum vollständigen Verlust der anfänglichen Prämie führen. Verglichen mit anderen Assets, wie Währungen, bringt die Option keinen Gewinn im Verhältnis 1:1 mit dem Basiswert. In einigen Fällen kann der Basiswert wegen des Deltas bei einem Anstieg um 1 € nur 0,7 € Gewinn einbringen. Delta ist eine zentrale Größe im Optionshandel. Es zeigt an, wie stark sich der Kurs einer Option verändert, wenn sich der Basiswert, wie eine Aktie, um 1 € bewegt. Es zeigt damit auch, wie empfindlich die Option gegenüber Kursbewegungen ist. Zum Beispiel: Wenn eine Call-Option ein Delta von 0,2 hat und die Aktie um 1 € steigt, sollte der Kurs der Option um etwa 0,20 € steigen. Das Delta verändert sich im Laufe der Zeit. Am Anfang der Option, oder wenn die Option weit überbewertet ist, tendiert das Delta dazu, niedrig zu sein, weil die Wahrscheinlickeit eines Gewinns der Option geringer ist.Nachteile

Hier erklären wir Ihnen die Unterschiede zwischen der Call-Option und anderen Trading-Strategien. Long-Call-Option vs. Kauf von Aktien. Investoren benötigen weniger Kapital zur Initiierung eines Long-Call-Vertrages als beim Kauf von Aktien oder Anteilen. Dies reduziert das Risiko in Fällen, in denen der Vertrag keinen Gewinn bringt. Außerdem ist ein Investor am Aktienmarkt nicht zeitlich gebunden, wie im Fall des Optionshandels. Long-Call-Option vs. Short-Call-Option. Eine Short-Call-Option ist die Gegenposition zur Long-Call-Option. In dieser Strategie erhält der Verkäufer der Call-Option eine Prämie im Austausch für die Verpflichtung, den zugrundeliegenden Vermögenswert zum Ausführungspreis zu verkaufen, falls der Käufer sich entscheidet, die Option auszuüben. Dies ist eine bärische bzw. neutrale Strategie, abhängig vom Kontext, da der Verkäufer profitiert, wenn der Kurs des zugrundeliegenden Vermögenswerts unter dem Ausführungspreis bleibt. Das Risiko jedoch ist potenziell unbegrenzt, wenn der Preis des Vermögenswerts signifikant steigt, da der Verkäufer möglicherweise den Vermögenswert zu einem höheren Marktpreis kaufen muss, um ihn zum niedrigeren Ausführungspreis zu verkaufen.Long-Call vs. andere Strategien

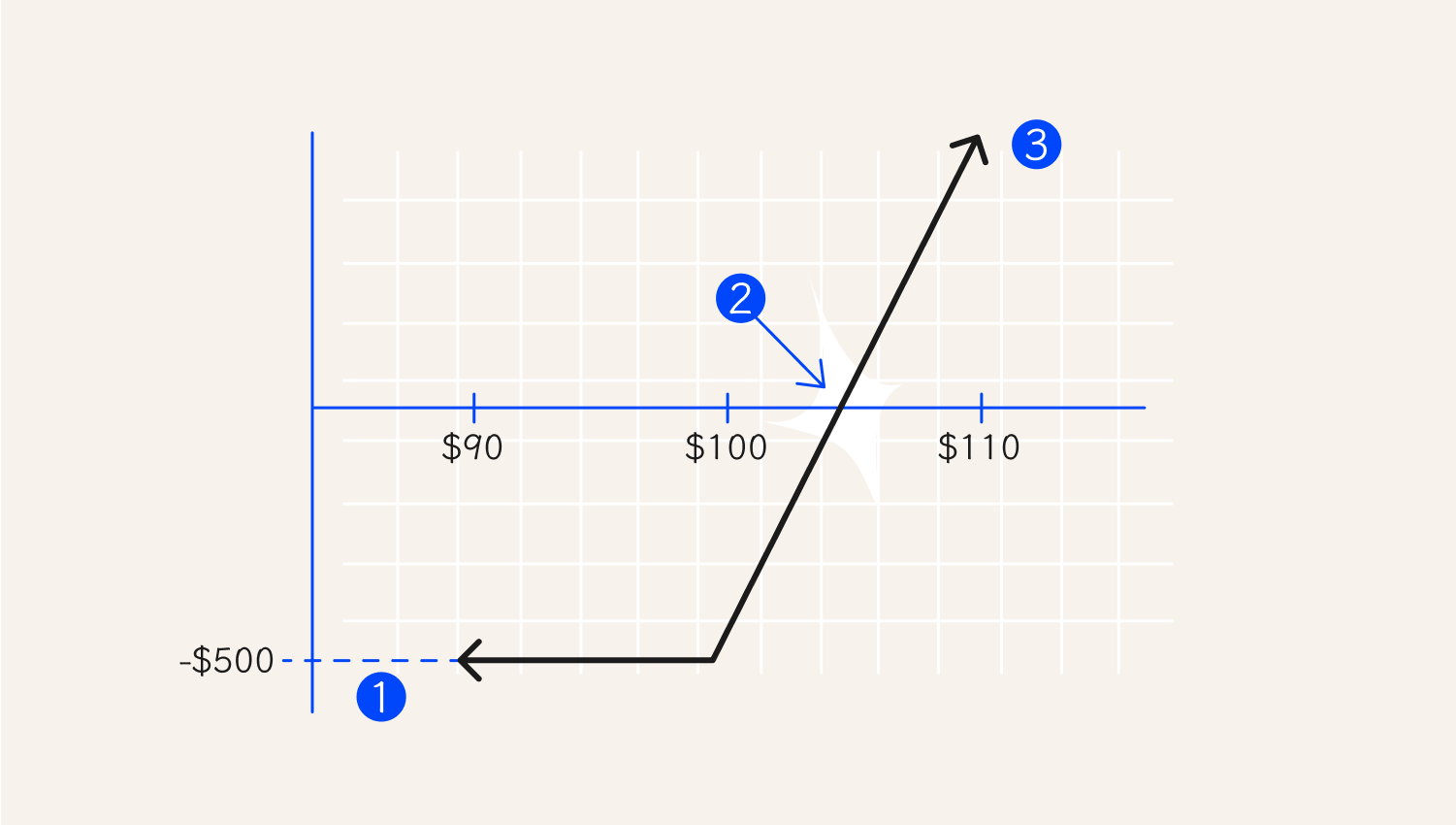

Der untenstehende Chart erklärt die Long-Call-Option. Erstens sollten Investoren beachten, dass das maximale Risiko auf die Kosten der Option beschränkt ist. Daher ist das potenzielle Gewinnpotenzial unbegrenzt. Zweitens, um Geld zu verdienen, sollte der Kurs der zugrundeliegenden Aktie bei Auslaufen der Option höher sein als der Ausführungspreis. Im untenstehenden Beispiel hat eine Long-Call-Option mit einem Ausübungspreis von 100 $, die für 5 $ gekauft wurde, einen potenziellen Verlust von 500 $ und einen unbegrenzten Gewinn, wenn der Kurs weiterhin steigt. Es ist wichtig zu verstehen, dass der zugrundeliegende Kurs bei der Erhöhung höher als 105 $ sein muss, damit der Investor Geld verdient.Beispiele

1. Maximaler Verlust

2. Gewinnschwelle: 105 $

3. Maximaler Gewinn ist unbegrenzt

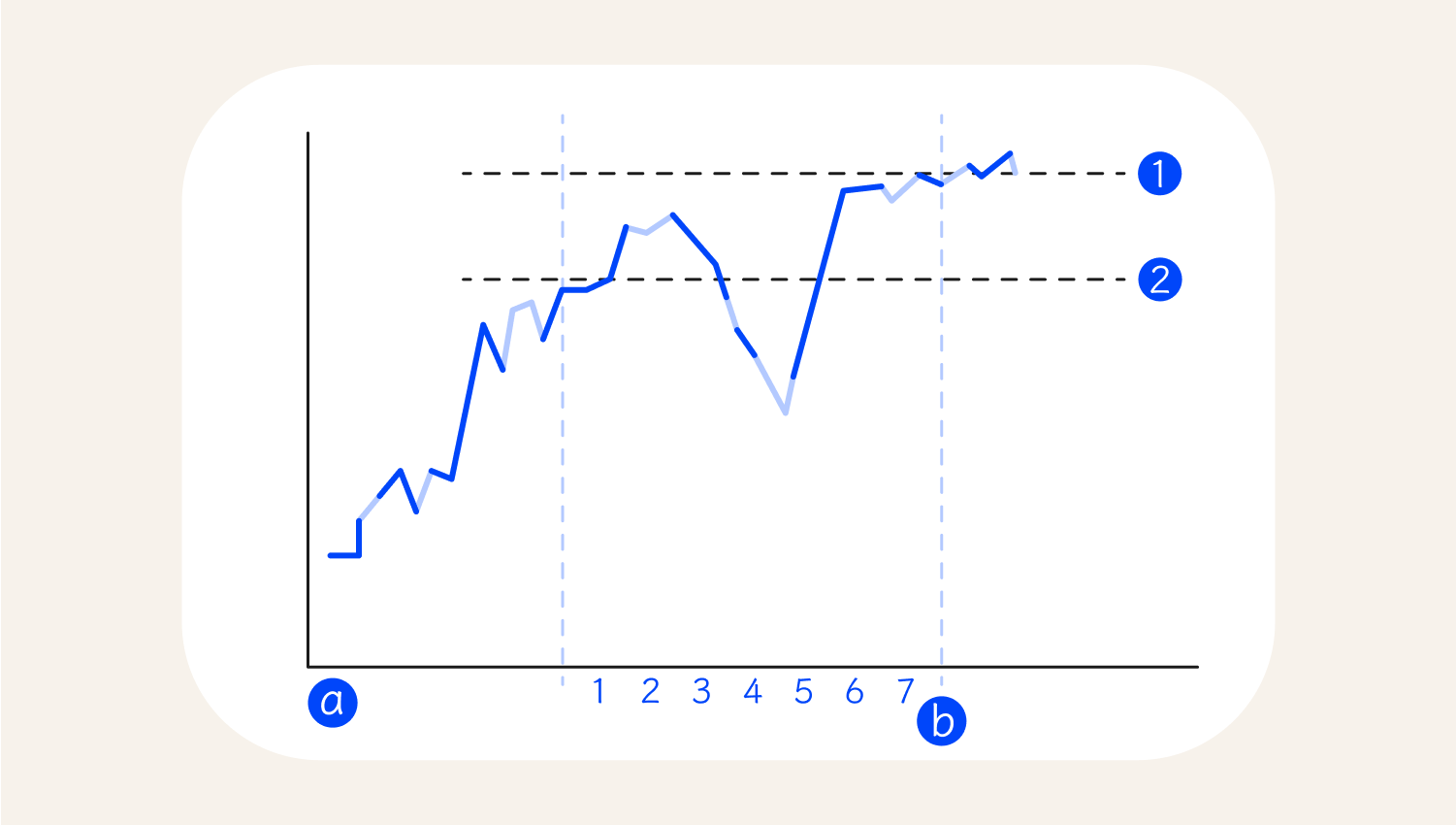

Der Einsatz einer Long-Call-Option beinhaltet den Kauf einer Call-Option, wenn Sie erwarten, dass der Kures des zugrundeliegenden Assets steigt. So verwenden Sie diese Strategie effektiv:So verwendet man die Long-Call-Option

1. Gewinn

2. Ausführungspreis

a. Tage

b. Ablaufdatum der Option

Klein anfangen. Wenn Sie neu im Optionshandel sind, ist es klug, klein anzufangen, da dies Ihnen Zeit gibt, den Markt zu verstehen und Erfahrung zu sammeln. Denken Sie auch daran, dass das Trading riskant ist – investieren Sie nicht mehr, als Sie bereit sind zu verlieren. Verwenden Sie die technische Analyse. Seit Jahrzehnten nutzen alle Investoren technische Indikatoren, um potenzielle Einstiegs- und Ausstiegspunkte zu identifizieren. Außerdem können Sie in der technischen Analyse Chartmuster hinzufügen, wie Kerzenmuster, um Ihre Strategie zu verbessern. Bleiben Sie informiert. Gute Investoren sind ständig auf dem Laufenden über die grundsätzlichen Elemente, die den Markt beeinflussen. Wählen Sie daher Blogs oder Kanäle aus, die Sie mit Nachrichten wie Ergebnisberichten, Verbraucherpreisindizes und anderen wichtigen Faktoren, die Ihre gewählten Assets erheblich beeinflussen, informiert halten. Diversifizieren Sie Ihr Portfolio. Investieren Sie nicht Ihr gesamtes Kapital in ein einzelnes Asset. Durch das Erstellen eines diversifizierten Portfolios erhöhen Sie Ihre Erfolgschancen, da die unprofitablen Positionen durch andere ausgeglichen werden.So steigert man seine Erfolgschancen

Abschließende Gedanken