Back

9 Feb 2022

Crude Oil Futures: Still scope for further correction

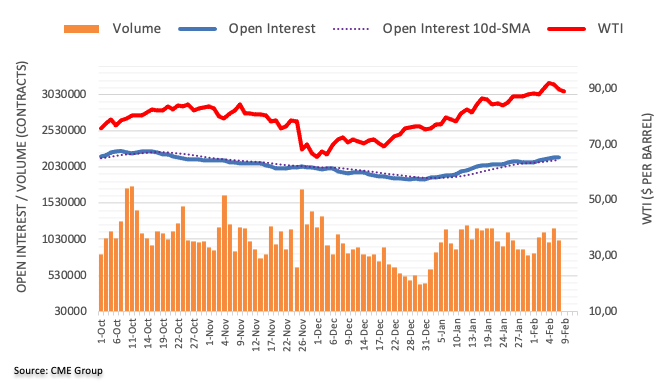

CME Group’s preliminary readings for crude oil futures markets noted traders added around 8.4K contracts to their open interest positions on Tuesday, recording the fifth consecutive daily build. Volume, instead, partially reversed the previous drop and increased by nearly 164K contracts.

WTI could retest the $86.78 level

Prices of the WTI added to the bearish mood seen at the beginning of the week on Tuesday. The corrective downside was in tandem with rising open interest, opening the door to potential further decline in the very near term. That said, the so far monthly low at $86.78 (February 3) emerges as the next magnet for oil bears. The sharp drop in volume, in the meantime, could spark some bouts of consolidation at the same time.