GBP/USD bears breaking through critical structures

- GBP/USD bears are taking charge below daily resistance and eye the 1.3780s.

- The US dollar has found renewed backing from market participants following the largest gain in NFP since August 2020.

GBP/USD is trading a touch lower on the day, down 0.15% at the time of writing after sliding from a high of 1.3894 to a low of 1.3840 printed within the last hour of trade.

The markets are in consolidation and are still digesting Friday’s jobs report; Nonfarm Payrolls showed that 943k jobs were added and it was the largest gain in NFP since August 2020.

The US dollar is better bid on the back of the data, taking on the bears at fresh daily highs and resistance structure as measured by the DXY index:

Fed hawks will have been emboldened by the data.

''It's worth noting that in the June Dot Plots, 7 FOMC members saw the first hike coming in 2022 while the median was 2023,'' analysts at Brown Brothers Harriman said, adding that ''if 3 members move forward their timing from 2023 to 2022, then the median becomes 2022.''

''New Dot Plots will come at the September 21-22 meeting and we think it's very possible that we see another hawkish shift there that will underscore that Fed tightening risks are rising.''

Meanwhile, US July inflation data will take centre stage this Wednesday, in the Consumer Price Index with headline expected to fall a tick to 5.3% YoY and core expected to fall two ticks to 4.3% YoY. The Producer Price Index will be on Thursday.

These will be the last key inflation readings until Jackson Hole Symposium to be held August 26-28. Of note, the Fed’s preferred measure of core PCE will be reported on August 27.

The Jackson Hole will be keenly eyed for a more explicit tapering timeline from the Federal Reserve which could lead to additional support for the greenback.

If not, then the September FOMC meeting will be in high anticipation of an official tapering announcement.

''There has been so much tapering talk that the Fed probably won’t wait long between the announcement and implementation and so we continue to look for tapering before year-end,'' the analysts at BBH said.

Meanwhile, domestically, the pound has been under some demand following the recent Bank of England decision.

However, the demand, at least in the spot market, has started to decay with a fresh low printed today since the meeting, despite the rise in net longs.

Sterling experienced a rise in net-longs worth 3% of open interest according to the latest CFTC data.

GBP positioning is now fully neutral as the Delta variant spread in the UK is somewhat abating and after profit-taking of shorts heading into the BoE last Thursday,

The Bank of England still offers a largely supportive underlying narrative for the pound going forward.

How soon the pound might start to reflect a slightly more hawkish tilt in what is a strong bullish environment for the US dollar, might depend on this week's monthly data dump Thursday.

The second quarter Gross Domestic Product is expected to grow 4.8% QoQ vs. -1.6% in the first quarter, Q1.

On a monthly basis, the GDP data is expected to rise 0.8% MoN, as it did back in May.

Industrial Production and Services will also be looked over by investors as will the trade surplus.

However, the key data to watch for will report on the third quarter readings considering the reopening following the so-called 'Freedom Day' where the UK government relaxed lockdown restrictions.

The July data will be much more important.

''High-frequency data so far suggest that the boost to the economy has been underwhelming,'' the analysts at BBH said.

GBP/USD technical analysis

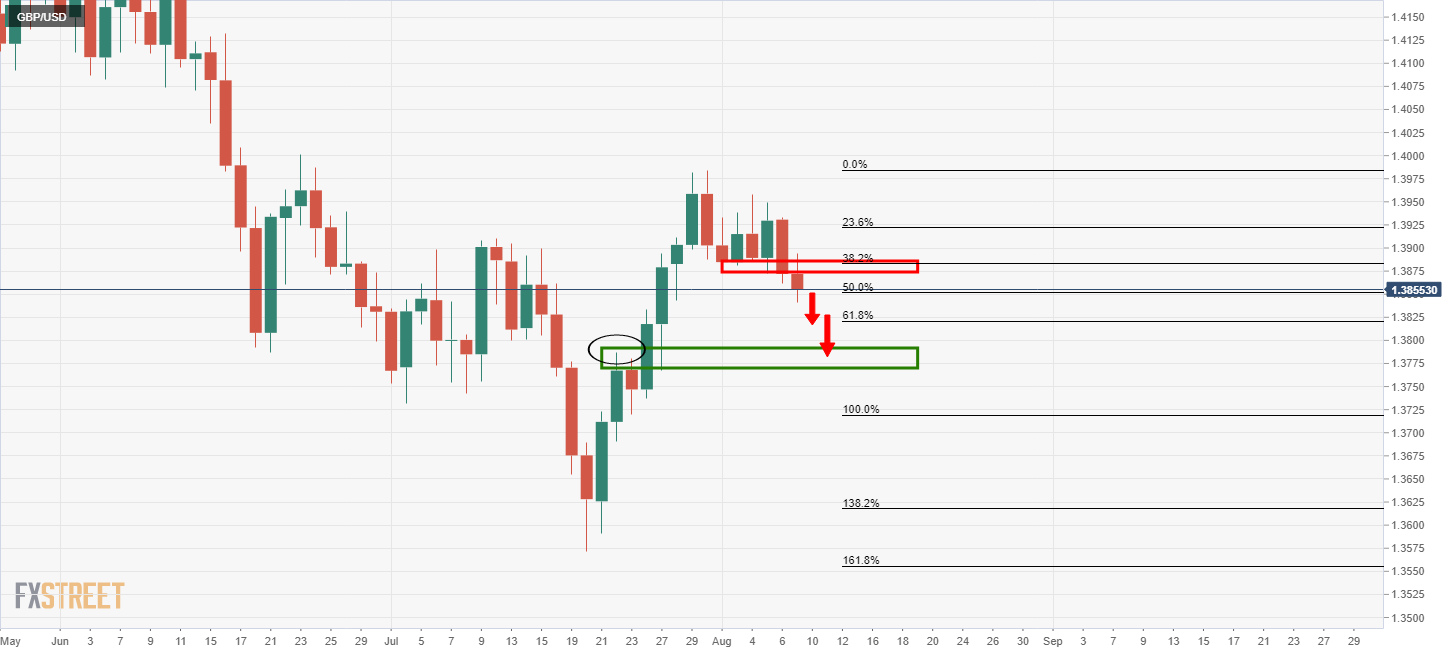

From a daily perspective, bears have taken price below daily support that would now be expected to act as resistance in 1.3870.

Cable is subsequently breaking the 38.2% Fibonacci retracement level in a correction of the prior daily bullish impulse.

It is testing the 50% mean reversion also and a break of which would be expected to see the 61.8% Fibon breached as well due to the momentum of the breakoutout and prevailing bear trend.

For additional conviction, the W-formation is a reversion pattern with a high completion rate to price reverting to the neckline of the structure, in this case at 1.3787.