Back

26 Jul 2021

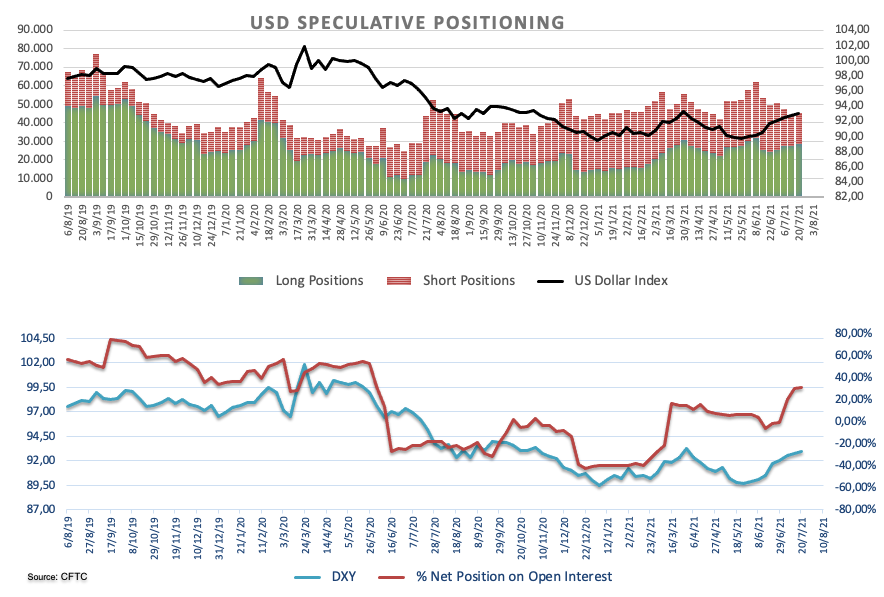

CFTC Positioning Report: Dollar net longs at 14-month highs

These are the key takeaways of the CFTC Positioning Report for the week ended on July 20th:

- Speculators added gross longs to the dollar position for yet another week, taking net longs to the highest level since late May 2020. The re-emergence of the risk aversion on the back of COVID jitters and the increased inflows into the safe haven space continued to lend support to the buck apart from the usual suspects: high inflation, prospects of QE tapering, economic recovery.

- By contrast, net longs in EUR dropped to levels last recorded in mid-March 2020, as traders positioned for a dovish outcome from the ECB gathering. Renewed concerns over the spread of the Delta variant and the potential negative impact on the recovery in the region also collaborated with the move lower in the spot market.

- The sterling returned to the negative territory for the first time since December 2020. Doubts surrounding “Freedom Day” vs. the rapid pick-up of coronavirus cases (mainly the Delta variant) weighed on the quid, while the BoE’s renewed patient stance and views of transitory UK high inflation also added to the weakness in cable.

- In the safe-haven universe, JPY net shorts receded to 4-week lows and CHF net longs climbed to 2-week highs, always amidst the recent markets’ shift to the risk-off trade.

- Net shorts in VIX (aka “the panic index”) retreated to levels last seen in late May 2020.