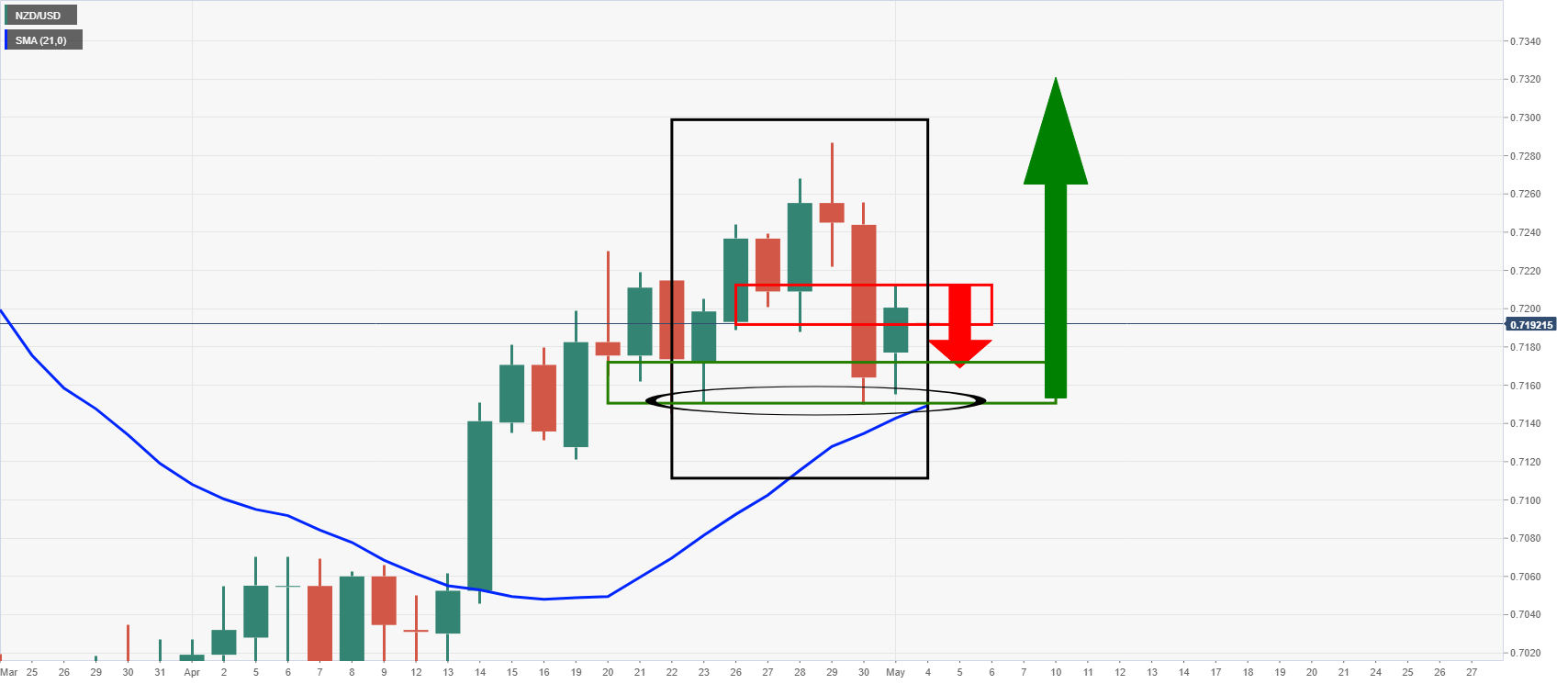

NZD/USD bulls target a break of daily resistance

- NZD/USD bulls are in town but the resistance could hold.

- The M-formation has been completed, so it is make or break time for the pair.

NZD/USD is currently trading at 0.7194 and between a range of 0.7186 and 0.7203. Overnight, the pair rose 0.6% to 0.7205 as the greenback to a back seat, pressured as investors look towards a week full of key US data.

The USD gave up on month-end gains and US bond yields fell which was a double whammy ahead of this week's Nonfarm Payrolls data.

Meanwhile, we are trading in thin market conditions so moves can be over-exaggerated.

Most of Asia and Europe out for the May Day holidays or the equivalent.

As for the first cohort of critical data, the US ISM data softened but is still strong in level terms, according to analysts at ANZ bank.

''The prices paid component ticked up, fuelling the inflation thematic that has been driving markets and calls for earlier central bank rate hikes, which could dent risk appetite and the NZD’s prospects if sustained.''

The analysts also argue that the next few days could be volatile, with the Q1 HLFS data out tomorrow.

''With the Reserve Bank of New Zealand looking for more surety before it makes its next move, the data won’t deliver definitive answers, but it’ll shape the narrative in the near term.''

NZD/USD techcial analysis

As for the technicals, the solid support is compelling as given the confluences.

Following the recent completion of the M-formation, the resistance might give but it could also see bull's struggle the first attempt resulting in a restest of support.