Back

11 Feb 2021

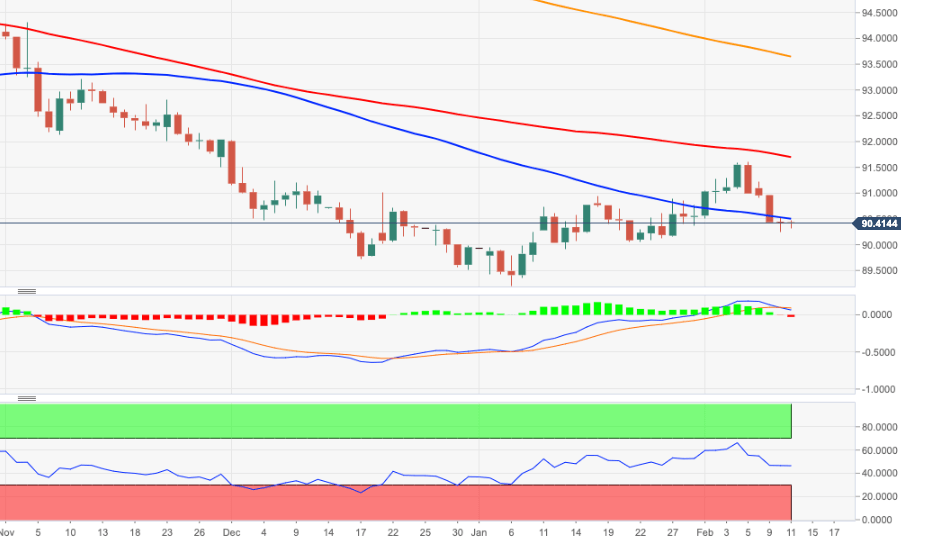

US Dollar Index Price Analysis: A breakdown of 90.00 is still likely

- The downside in DXY meets decent support around 90.20.

- A breach of this level should open the door to 89.20.

DXY’s decline appears to have met quite decent contention in the low-90.00s for the time being. This zone is also reinforced by the 2020-2021 support line, currently near 90.30.

A sustainable breach of this area should open the door to a probable visit to the weekly lows around 90.00 (January 22) in the next sessions. Below this psychological level is located the 2021 lows around 89.20 ahead of the March 2018 low at 88.94.

In the meantime, occasional bouts of upside pressure in the dollar are seen as corrective only and in the longer run, as long as DXY trades below the 200-day SMA (93.64), the bearish stance is expected to persist.

DXY daily chart