Back

29 Jan 2021

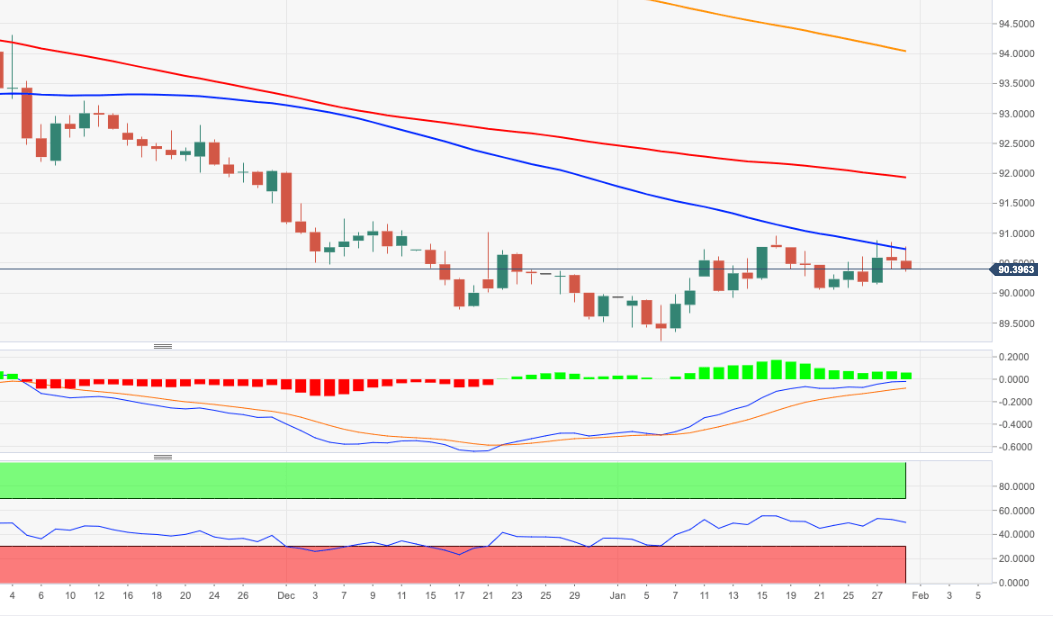

US Dollar Index Price Analysis: Upside capped by the resistance line near 90.80

- DXY meets solid resistance in the 90.80 region on Friday.

- The 2020-2021 resistance line also sits around this region.

DXY extends the rejection from weekly highs below the 91.00 mark, shedding ground for the second session in a row on Friday.

The continuation of the downtrend is expected to meet the next support of relevance around the 90.00 neighbourhood. That said, a breach of this region should not surprise anyone in the short-term horizon, while further south is located the 2021 lows around 89.20 ahead of the March 2018 low at 88.94.

Occasional bullish attempts in DXY are seen as corrective only and in the longer run, as long as DXY trades below the 200-day SMA (94.03), the negative view is expected to persist.

DXY daily chart