EUR/USD keeps the cautious trade near 1.2130

- EUR/USD navigates within a narrow range around 1.2130.

- US stimulus talks entered an impasse, Brexit limbo persists.

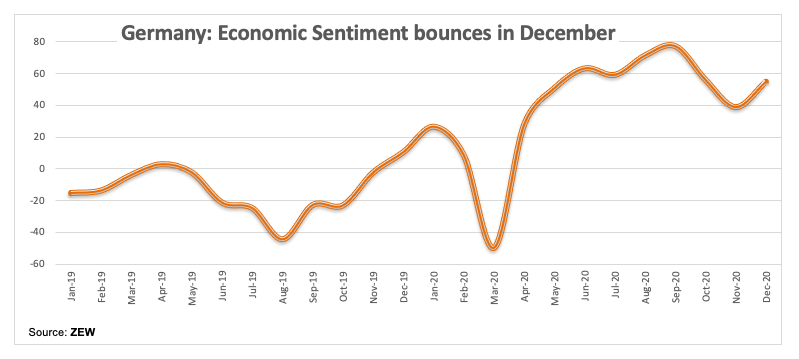

- German Economic Sentiment rebounds to 55.0 in December.

EUR/USD keeps the positive mood unchanged around the 1.2130 region in the wake of the opening bell in Wall St on Tuesday.

EUR/USD looks vigilant ahead of ECB

EUR/USD posts gains for the first time following two daily pullbacks in a row in spite of the broad-based cautious stance in the global markets.

Indeed, renewed US-China trade jitters coupled with stagnant stimulus talks and Brexit uncertainty continue to support - albeit mildly - the greenback so far this week.

Furthermore, fresh inflows into the single currency are seen coming in from the selling bias in the sterling, as EUR/GBP keeps navigating the area of 2-month peaks around 0.9100.

In the euro docket, the ZEW survey showed the German/EMU Economic Sentiment improved in December, while another revision of Q3 GDP in the euro area now sees the economy expanding 12.5% QoQ, a tad below estimates.

In the US calendar, the NFIB Index eased to 101.4 in November (from 104.0).

What to look for around EUR

The upside momentum in EUR/USD faltered in the proximity of the 1.22 barrier last week in spite of the favourable atmosphere in the risk complex. In the very near-term, EUR/USD appears supported by prospects of a strong recovery in the region along with the increasing likelihood of extra stimulus in the US. Risks to this positive view emerge from the potential political effervescence surrounding the EU Recovery Fund and increasing chances of further ECB easing to be announced as soon as at the December meeting (Thursday).

EUR/USD levels to watch

At the moment, the pair is gaining 0.16% at 1.2125 and a breakout of 1.2177 (2020 high Dec.4) would target 1.2413 (monthly high Apr.17 2018) en route to 1.2476 (monthly high Mar.27 2018). On the other hand, the next support emerges at 1.1920 (high Nov.9) seconded by 1.1800 (low Nov.23) and finally 1.1745 (weekly low Nov.11).