Back

21 Jul 2020

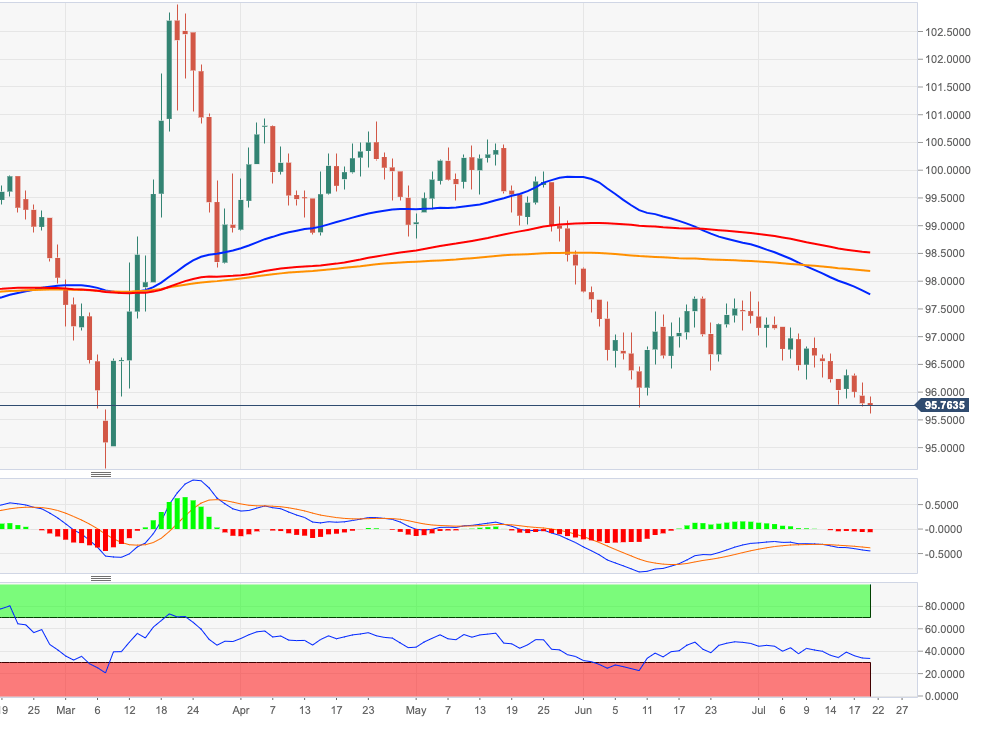

US Dollar Index Price Analysis: Door still open for a move to YTD lows near 94.60

- DXY struggles for direction around the 97.80/70 band on Tuesday.

- A deeper pullback is likely to visit the YTD lows in the 94.65/60 region.

DXY navigates the area of multi-month lows in the sub-96.00 zone on Tuesday, always under permanent downside pressure amidst the better mood in the risk complex.

Further retracements are increasingly likely, leaving the door wide open for a probable move and test of the yearly lows near 94.60 recorded in early March.

The negative outlook on the dollar is expected to remain unaltered while below the 200-day SMA, today at 98.17.

DXY daily chart