EUR/USD Price Forecast: Further downside stays in the pipeline

- EUR/USD manages to regain some composure in the 1.1170 region.

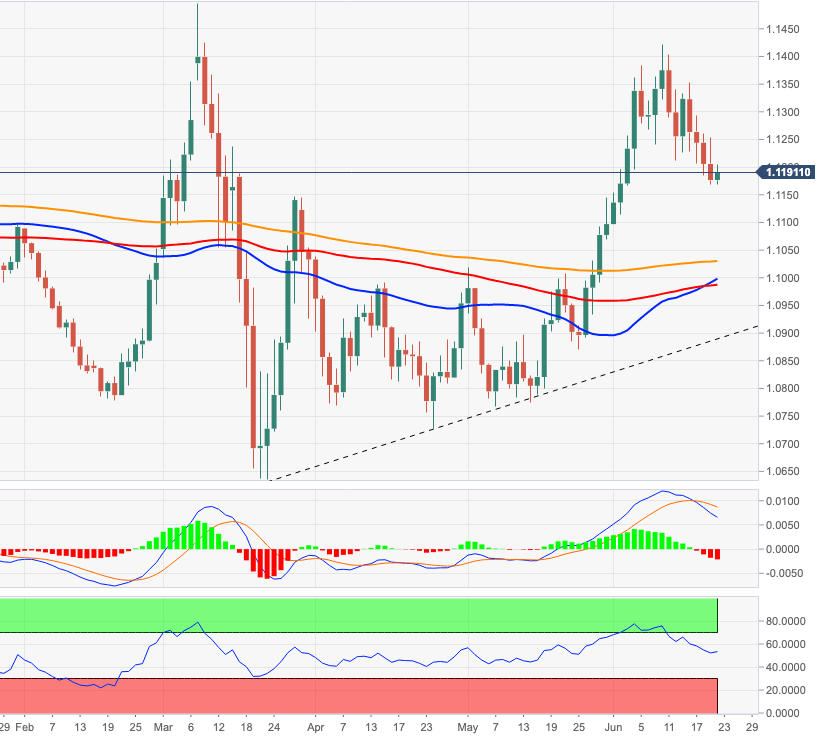

- A move to the 200-day SMA near 1.1030 looks likely near-term.

EUR/USD appears to have met some contention in the 1.1180/65 band at the end of last week, extending the leg lower following the rejection from monthly tops beyond 1.14 the figure recorded on June 10.

The immediate driver fo the pair’s price action comes from the risk appetite complex and its impact on the greenback, where the progress of the return to the economic normality (sort of) in the Old Continent and the potential resurgence of a second wave of the coronavirus outbreak remain in the centre of the debate.

Moving forward, preliminary PMIs and the German IFO survey should shed further details regarding the strength of the recovery in the euro area, while weekly Claims, another revision of the GDP figures and inflation tracked by the PCE will take centre stage across the pond.

Near-term Outlook

EUR/USD is holding on to the key Fibo level (of the 2017-2018 drop) at 1.1187 for the time being. A breach of this area on a sustainable basis should open the door to a probable visit to the critical 200-day SMA, today at 1.1027. On the other hand, while above this area, the outlook on the pair is expected to be on the constructive side and therefore another move to monthly tops in the 1.1420 region should not be ruled out in the short-term horizon.