Back

3 Jun 2020

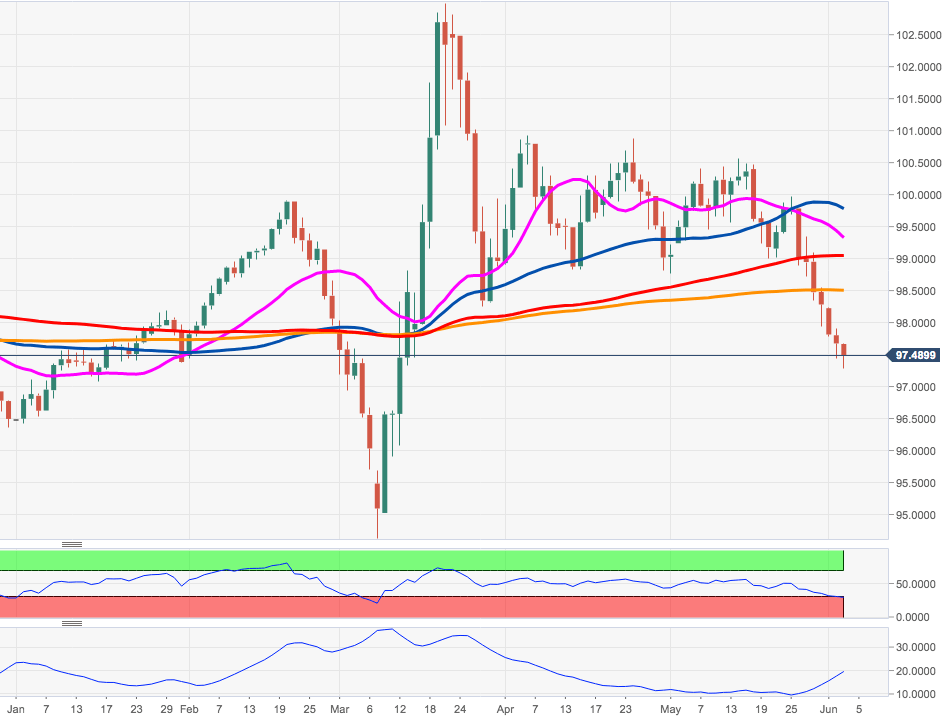

US Dollar Index Price Analysis: Rising odds for a drop to 97.00

- DXY remains under heavy pressure and approaches 97.00.

- Key contention emerges in the 97.00 neighbourhood ahead of 96.30.

DXY tumbled to new 3-month lows in the 97.30/25 band earlier on Wednesday, although it has managed to regain some composure soon afterwards.

Sellers remain in control and therefore further pullbacks remain well on the table with the potential target at the 97.00 zone, where sits the 2019-2020 support line.

Further south comes in the December 2019 lows in the 96.30 zone.

DXY daily chart