EUR/USD Price Analysis: Range play continues

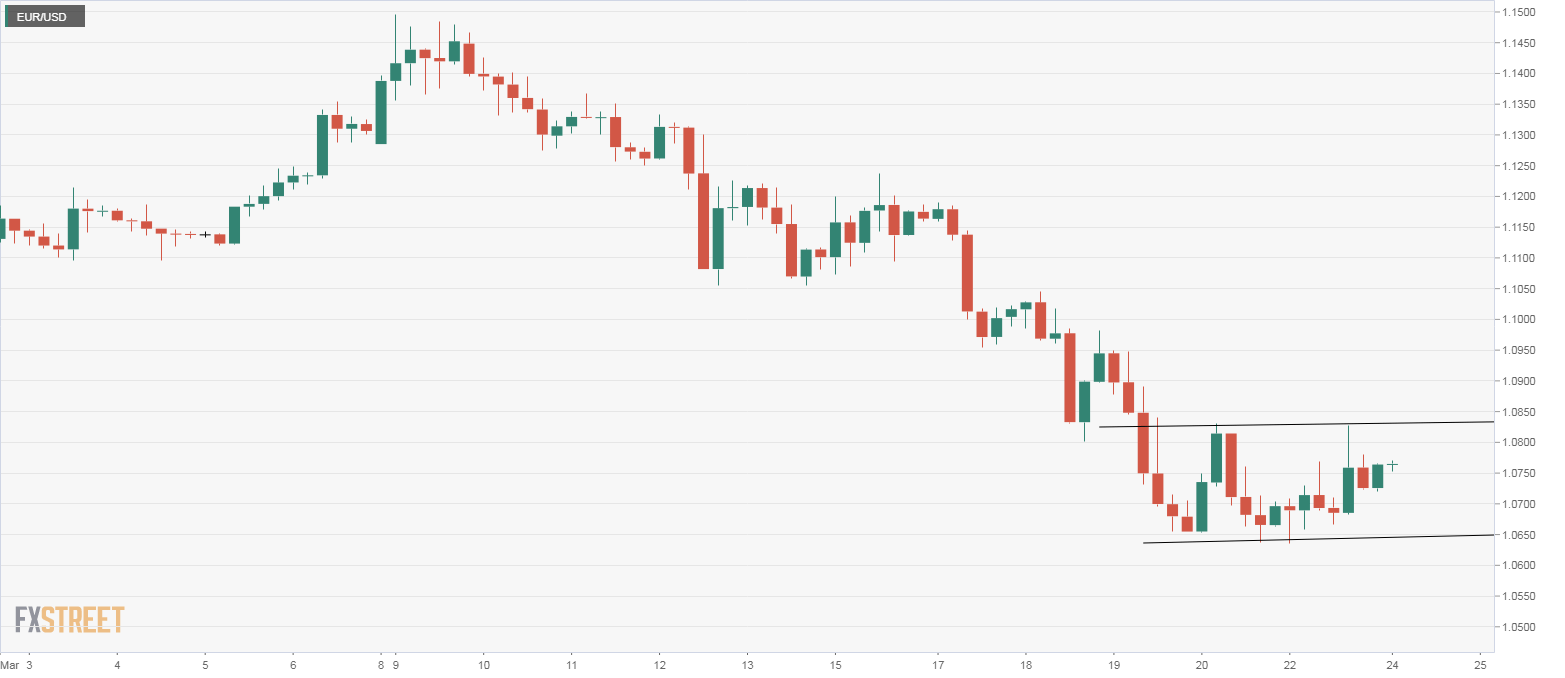

- EUR/USD is trapped in a sideways channel as per intraday charts.

- With the Fed launching unlimited QE, range breakout looks likely.

EUR/USD is lacking a clear directional bias for the third straight day, as the pair remains stuck in the range of 1.0830-1.0635.

A breakout, if confirmed, could bring gains toward 1.10. Alternatively, acceptance under 1.0635 would imply a continuation of the sell-off from the recent high of 1.1495.

The dollar funding stress is likely to ease now that the US Federal Reserve has announced an unlimited quantitative easing or an asset purchasing program to support financial markets amid the ongoing coronavirus crisis.

As a result, a range breakout looks likely, more so, as the consecutive doji-like candles seen on the daily chart are reflective of seller exhaustion.

At press time, the pair is trading at 1.0760, representing a 0.6% gain on the day.

4-hour chart

Trend: Neutral

Technical levels