Back

4 Mar 2020

GBP/USD Price Analysis: Bears looking to pounce for 61.8% Fibo retracement

- GBP/USD is en-route for a test of Friday's point of control located at 1.2874.

- Bears look for a correction back to Wednesday's point of control at 1.2811.

- A 61.8% Fibonacci retracement target of Wednesday's rally could set up a buying opportunity.

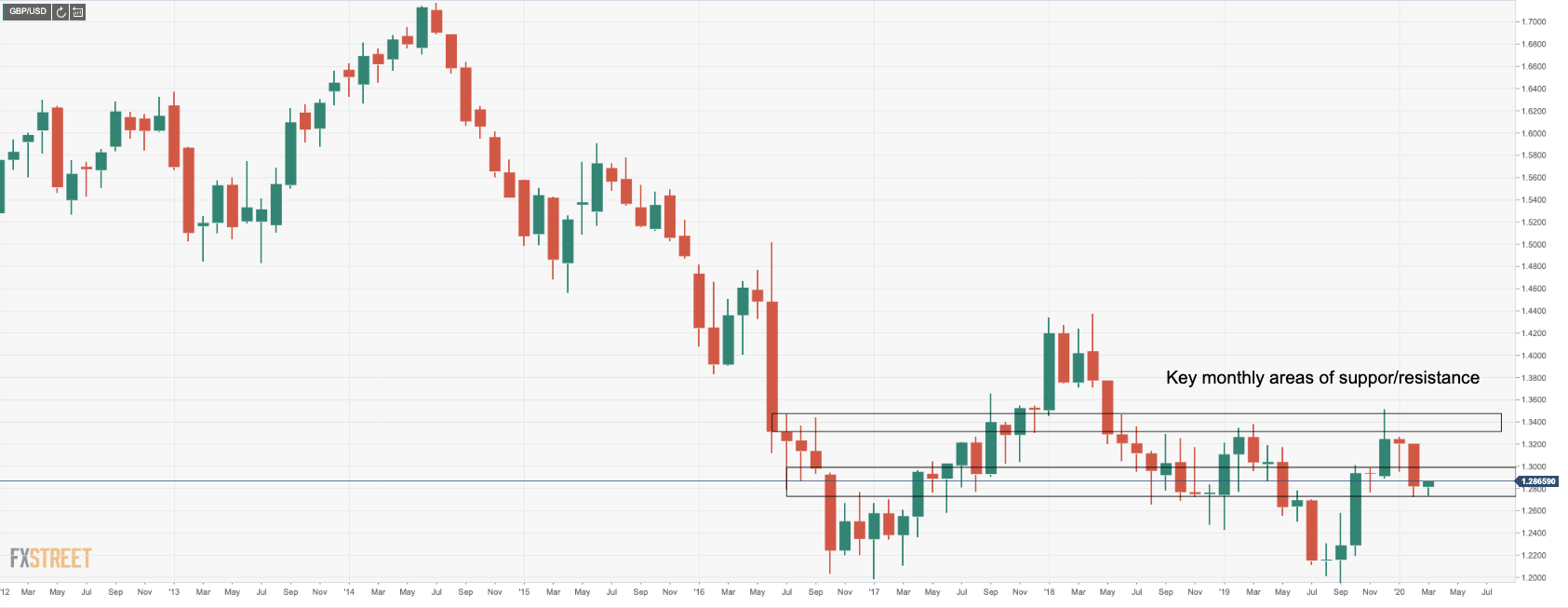

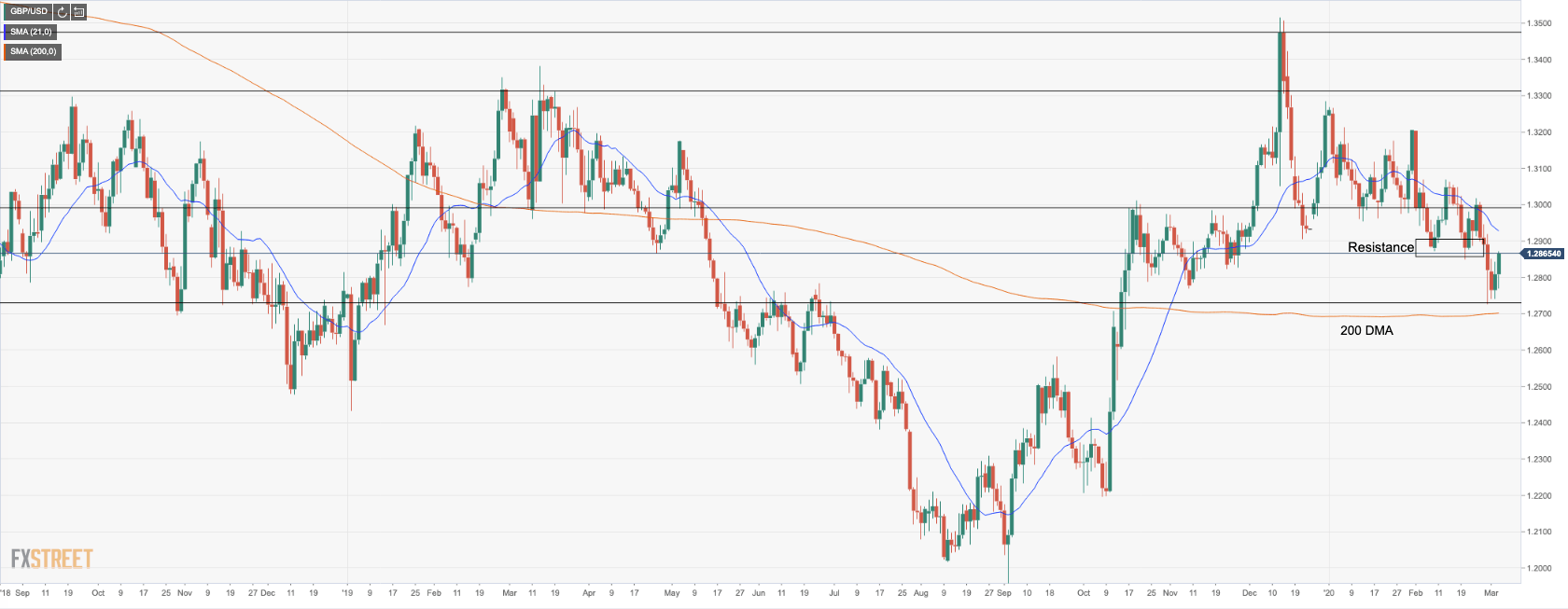

GBP/USD is trading within a monthly area of supports and resistances having rallied from the late 1.27 handle to a recent high of 1.2871, en-route for a test of Friday's point of control located at 1.2874. This is an area of resistance on the daily chart outlook, with price submerged below the bearish 21-DMA. Failures to close through here, with buying/accumulation volume slowing, will bring the case for a correction back to Wednesday's point of control at 1.2811 which ties up with a 61.8% Fibonacci retracement target of Wednesday's rally between 1.2770 and 1.2817.

Monthly areas of interest

Daily chart, price below 21-DMA and key resistance

4-HR chart, 61.8% target on the radar, volume peaked out