Back

11 Oct 2019

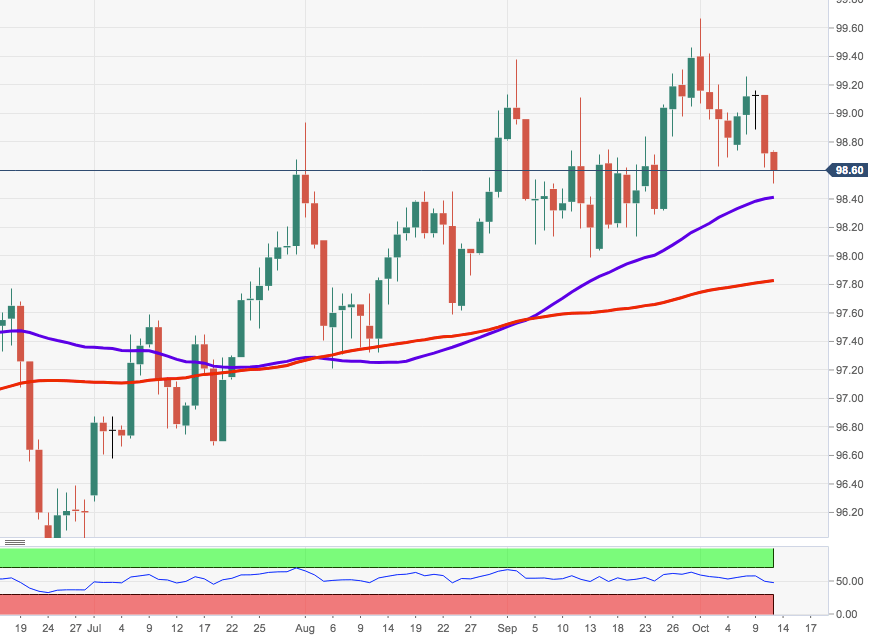

US Dollar Index Technical Analysis: The 55-day SMA at 98.36 expected to hold the downside

- DXY has exacerbated the downside after breaching the key support at 99.00 the figure, dropping to the area of fresh 2-week lows.

- The continuation of the selling impetus carries the potential to spark a deeper pullback to the 55-day SMA at 98.36, where it is expected to lose traction.

- However, a break below this area on a sustainable fashion could pave the way for a shift to a bearish view, with initial target at the 100-day SMA, today at 97.79.

DXY daily chart