Back

9 Oct 2019

EUR/USD technical analysis: Unfazed after the FOMC Minutes, trading sub-1.0985 resistance

- EUR/USD keeps the range theme of the last four days unchanged.

- FOMC minutes: Most fed policymakers believed 25 basis point cut needed.

- The level to beat for bears is the 1.0973/63 support zone.

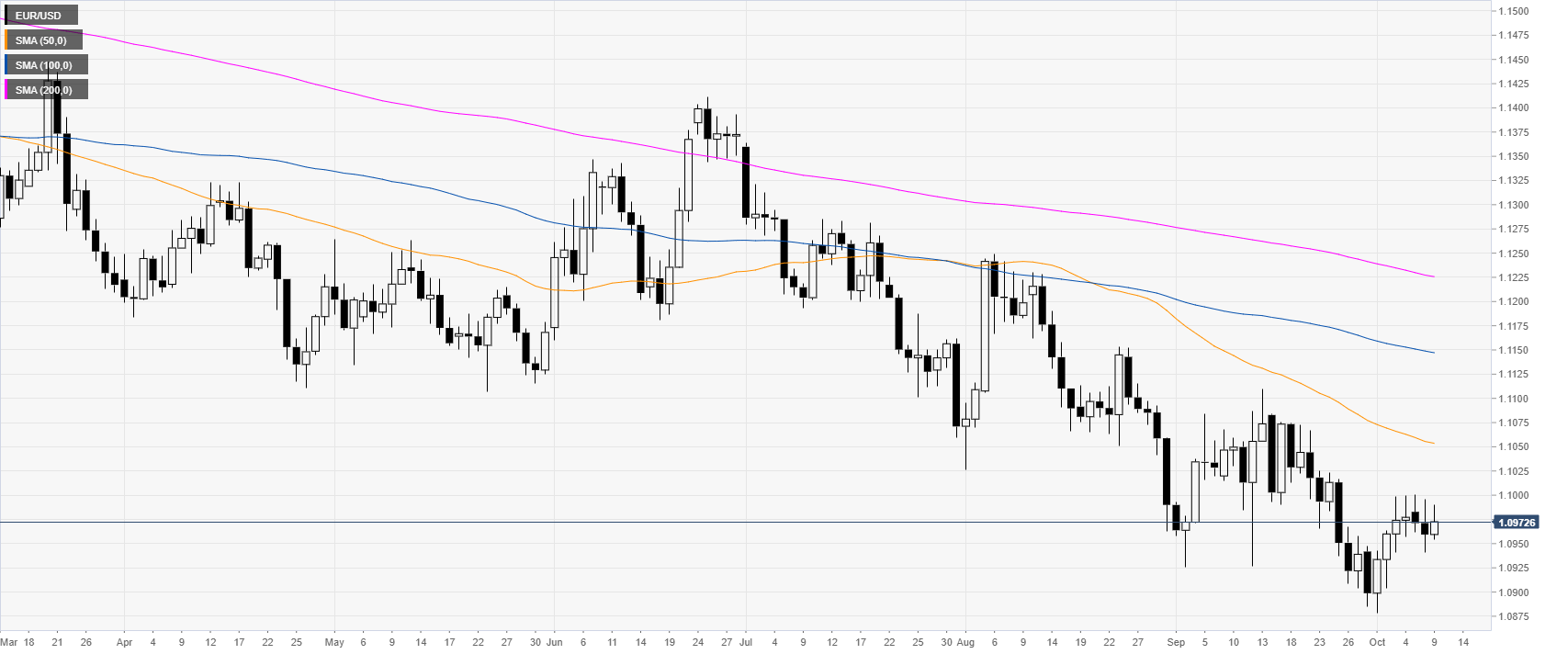

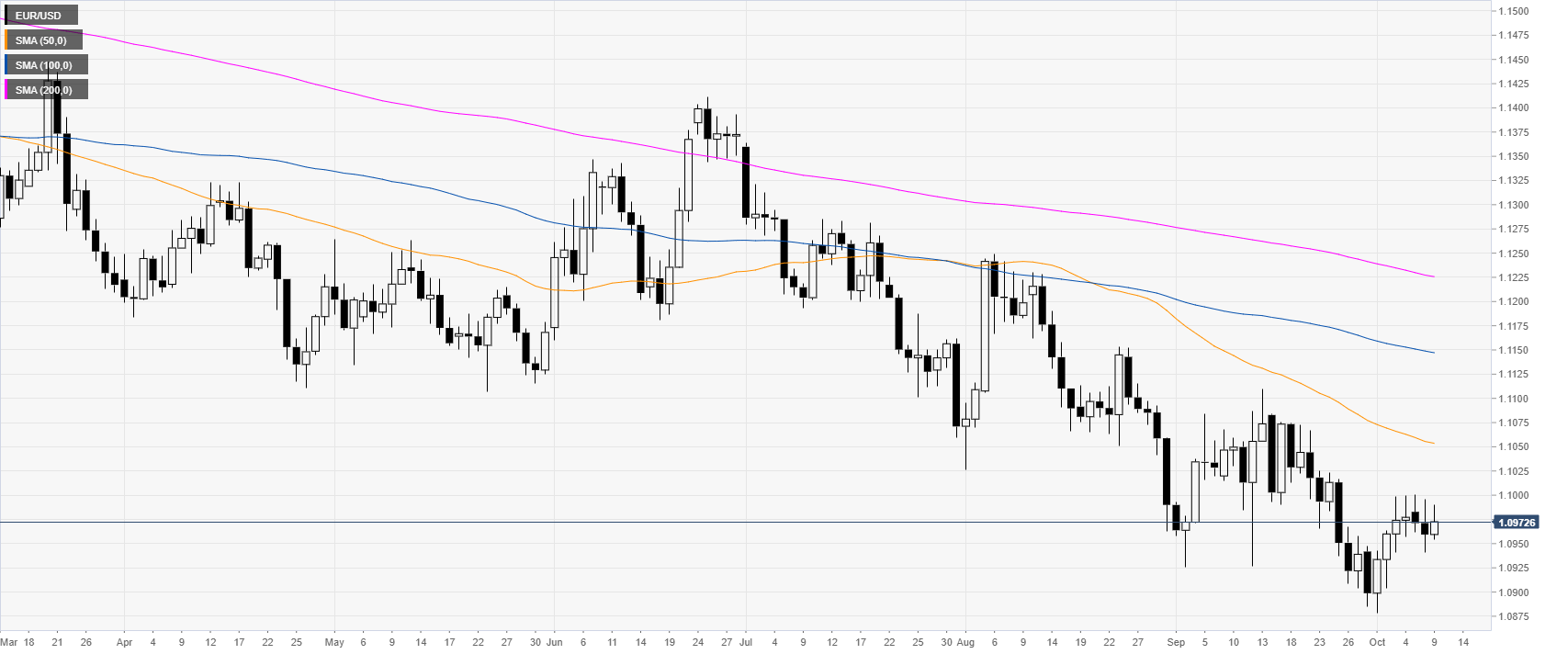

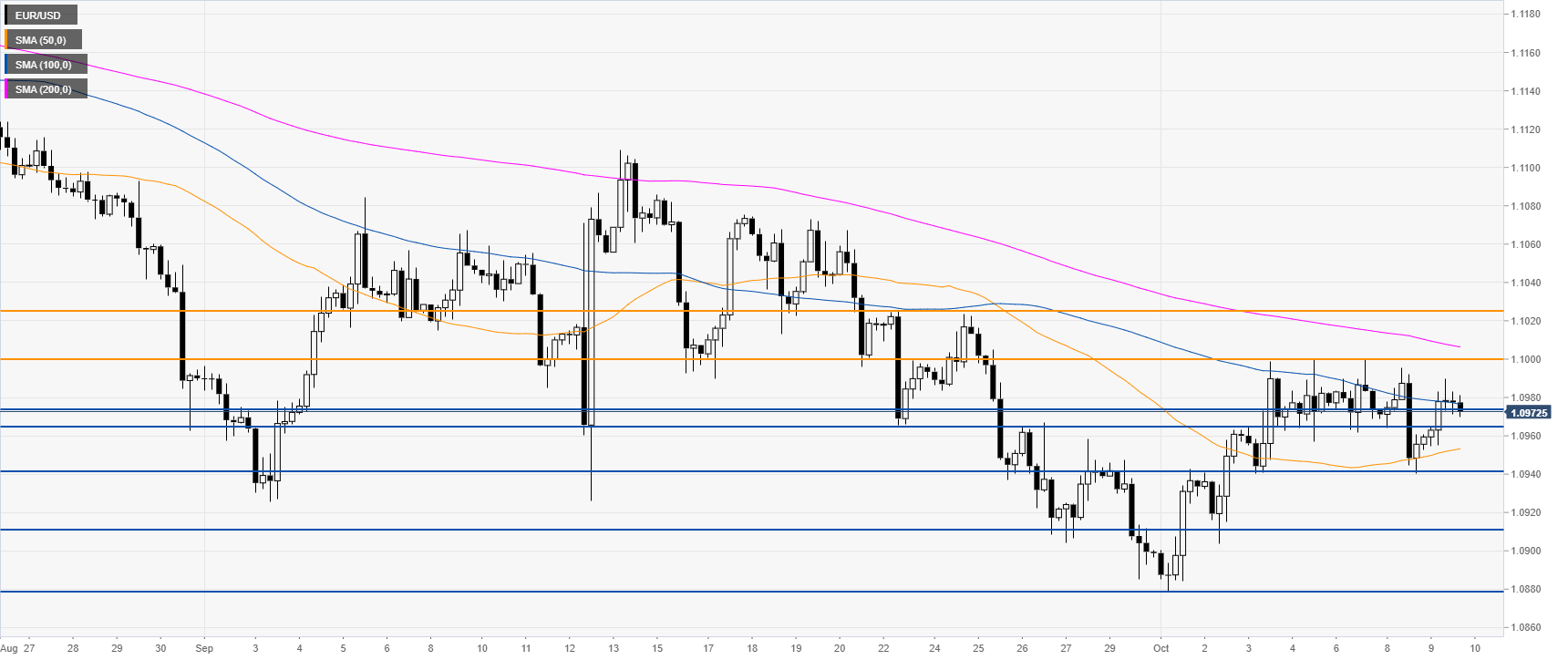

EUR/USD daily chart

On the daily chart, the common currency is trading in a downtrend below its main daily simple moving averages (DSMAs). The FOMC Minutes failed to provide new information as Chief’s Powell mainly reiterated known facts: “risks come from abroad, chances of a recession are limited, the economy overall is healthy.”

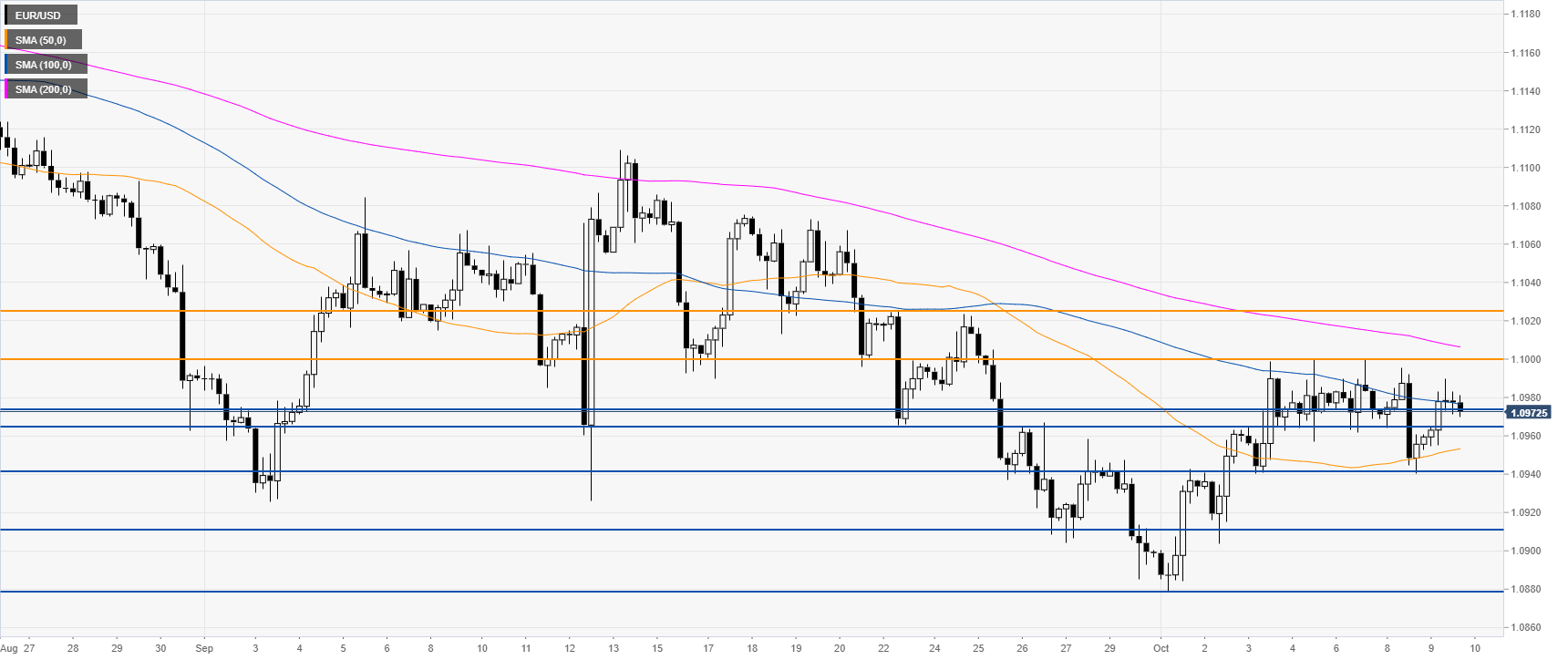

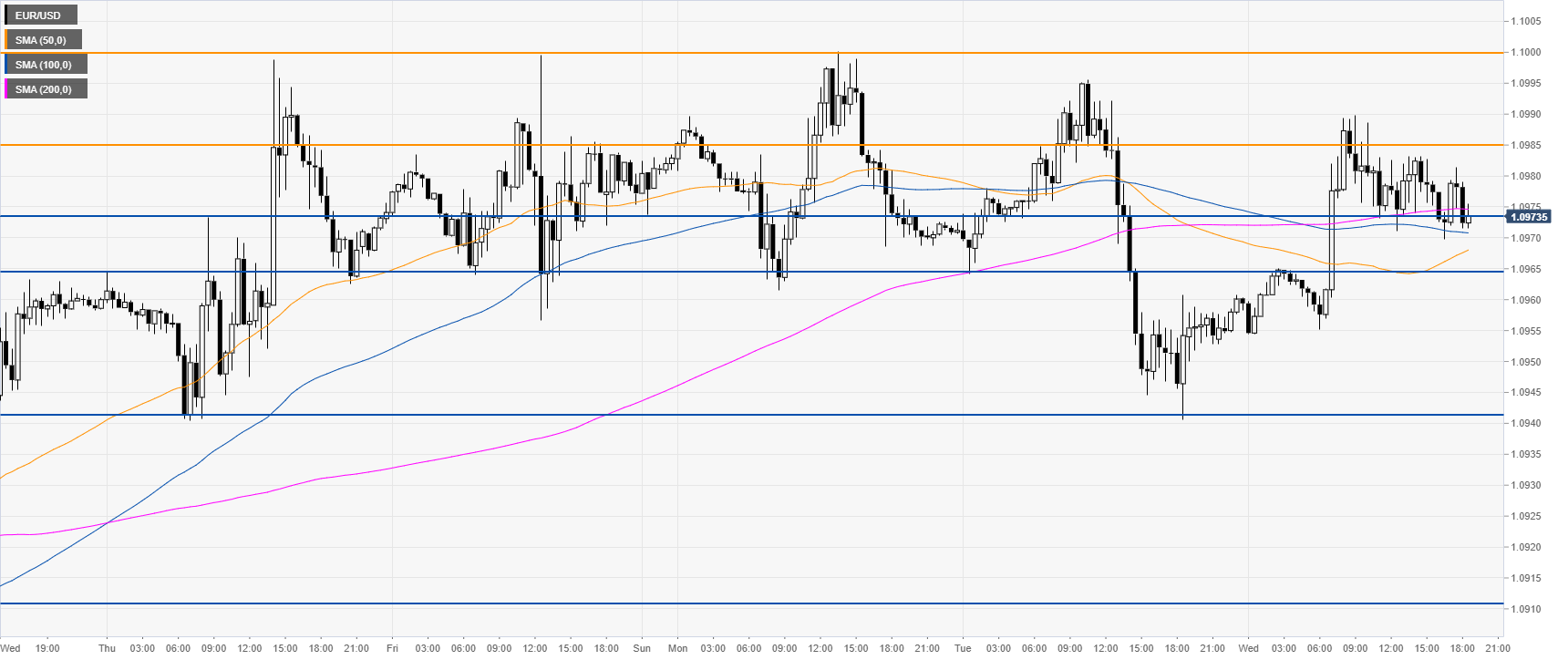

EUR/USD four-hour chart

EUR/USD is stuck in the 1.0965-1.1000 range while sticking most of the New York session near the 100 SMA. The market is currently challenging the 1.0973/65 support zone. A break below those levels can bring the 1.0940 support back into play, according to the Technical Confluences Indicator.

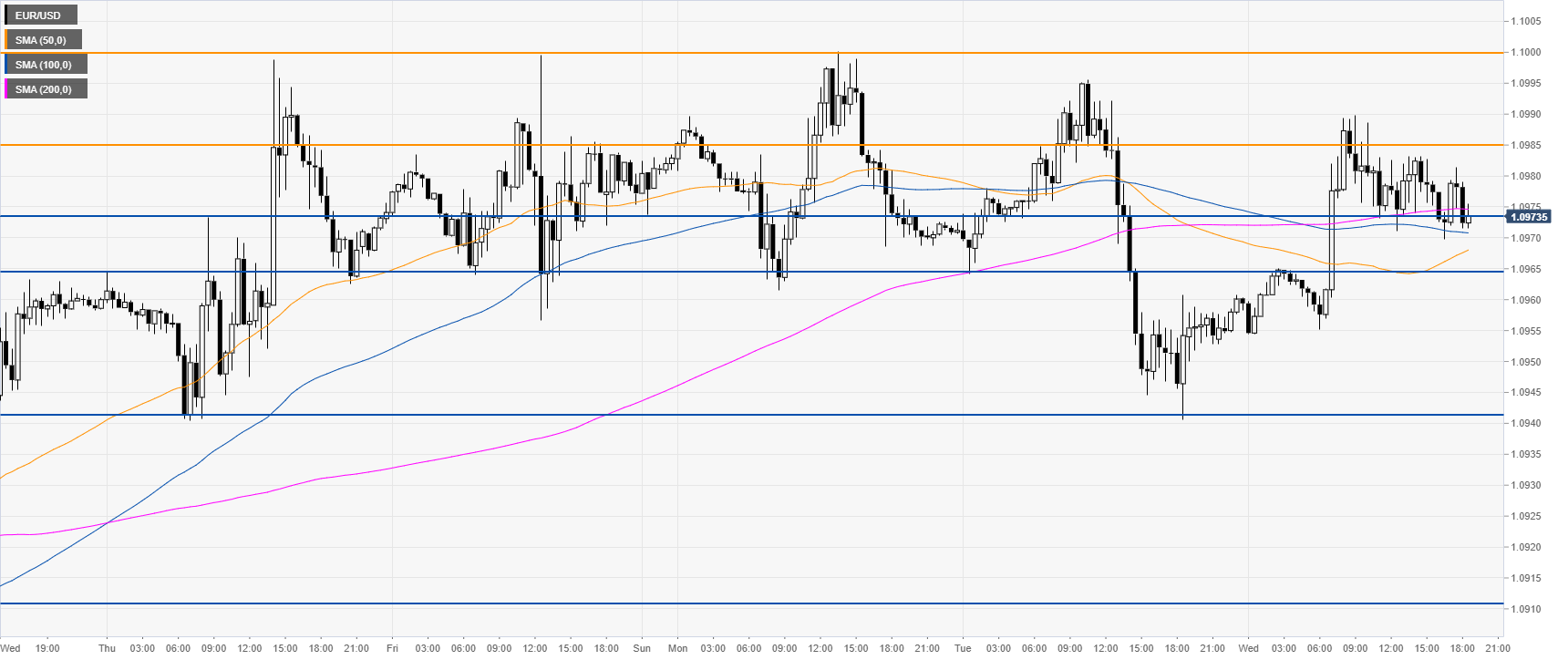

EUR/USD 30-minute chart

EUR/USD is trading flat near 1.0973 support. Resistances are seen at the 1.0983 level and the 1.1000 figure. A daily close above the 1.1000 figure would likely be needed to alleviate the downside bias.

Additional key levels