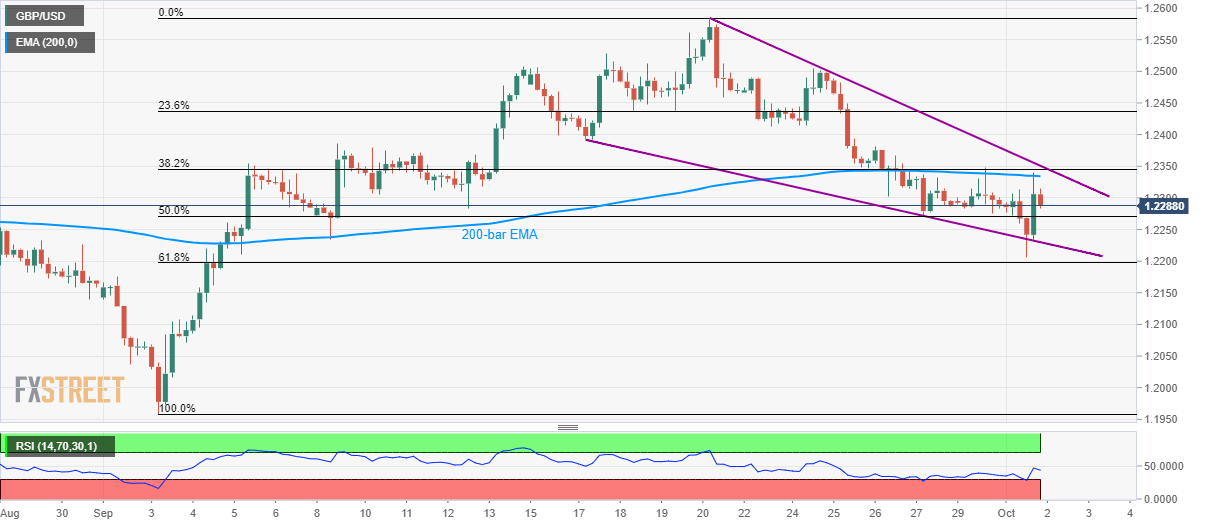

GBP/USD technical analysis: Another pullback from 200-bar EMA inside falling wedge

- GBP/USD forms a short-term bullish formation but key EMA limits immediate upside.

- 61.8% Fibonacci retracement offers additional support.

GBP/USD registers another U-turn from the 200-bar exponential moving average (EMA) as it declines to the intra-day low of 1.2283 by the press time of early Asian session on Wednesday.

With this the pair is likely to revisit 50% Fibonacci retracement of September month advances, nearing 1.2270 ahead of challenging support-line of a short-term bullish formation, “falling wedge”, at 1.2230 now.

In a case sellers defy the technical pattern by dominating below 1.2230, 61.8% Fibonacci retracement level close to 1.2200 becomes another challenge for them prior to targeting 1.2100 mark.

Meanwhile, the pair’s sustained break of 200-bar EMA level of 1.2335 needs validation from a successful run-up beyond pattern’s resistance-line, at 1.2350, in order to question the strength of 1.2415 and September 24 high close to 1.2505.

During the pair’s further rise above 1.2505, the previous month top of 1.2582 and 1.2600 round-figure could lure bulls.

GBP/USD 4-hour chart

Trend: pullback expected