Back

18 Sep 2019

AUD/USD technical analysis: Aussie regaining some poise ahead of the FOMC

- AUD/USD is ticking higher ahead of the FOMC at 18:00 GMT.

- The level to beat for buyers is the 0.6874 resistance.

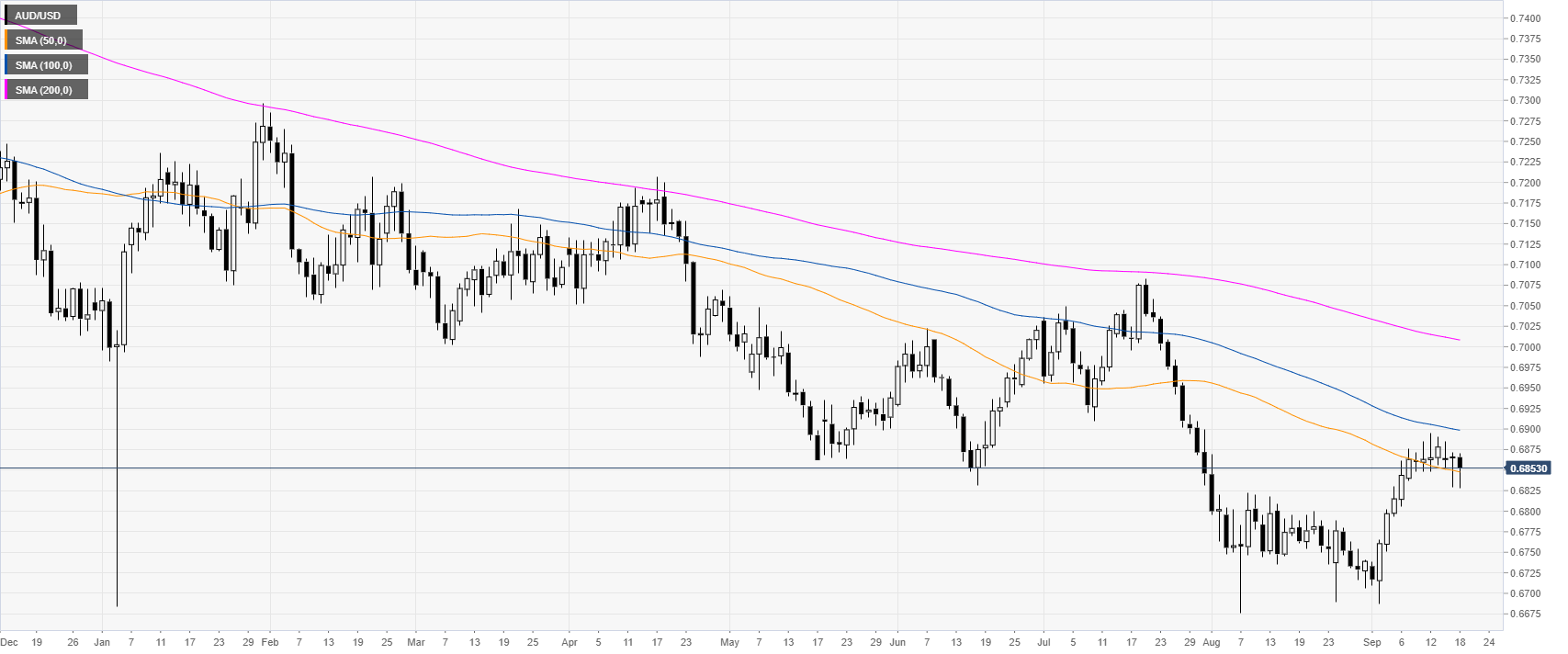

AUD/USD daily chart

AUD/USD is trading in a bear trend below the 100 and 200-day simple moving averages (SMAs). However, this September the Aussie has been rebounding sharply. All eyes will be on the FOMC at 18:00 GMT. The market has already priced in a 25 bps rate cut.

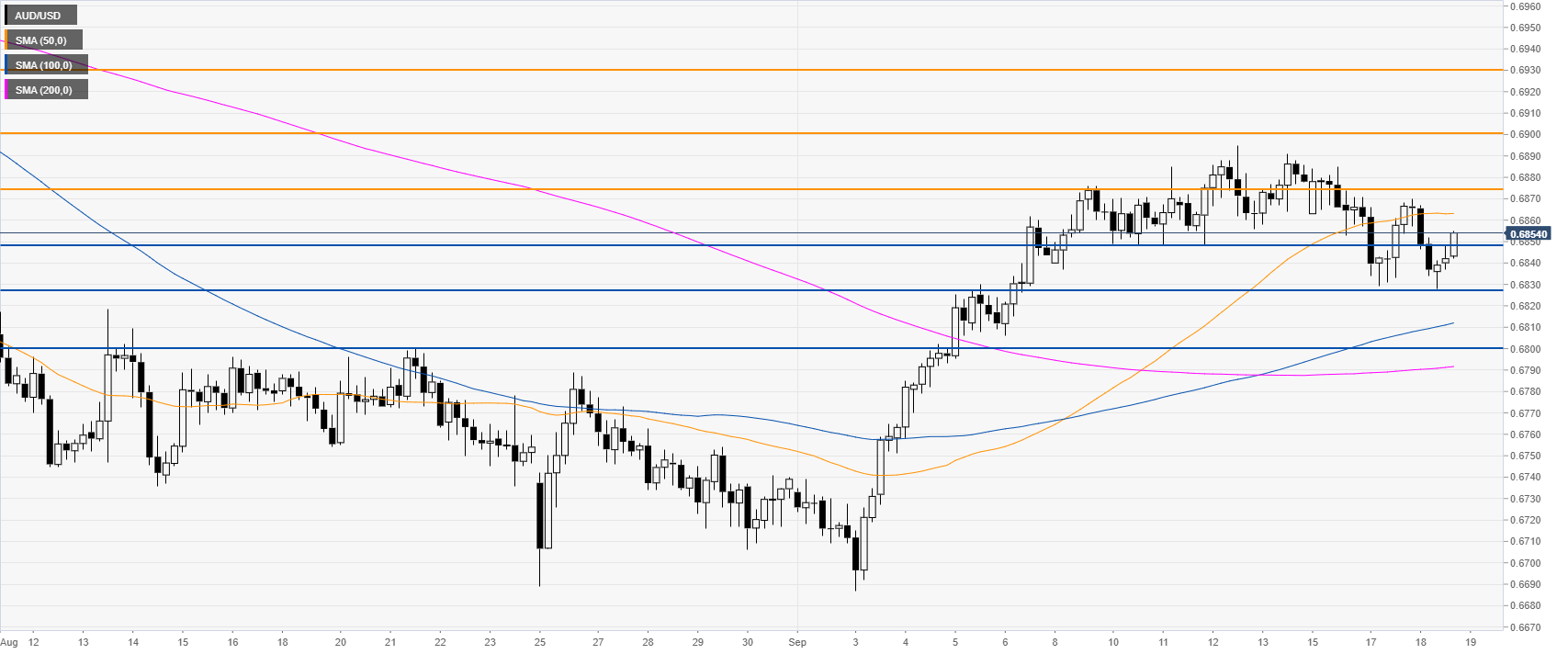

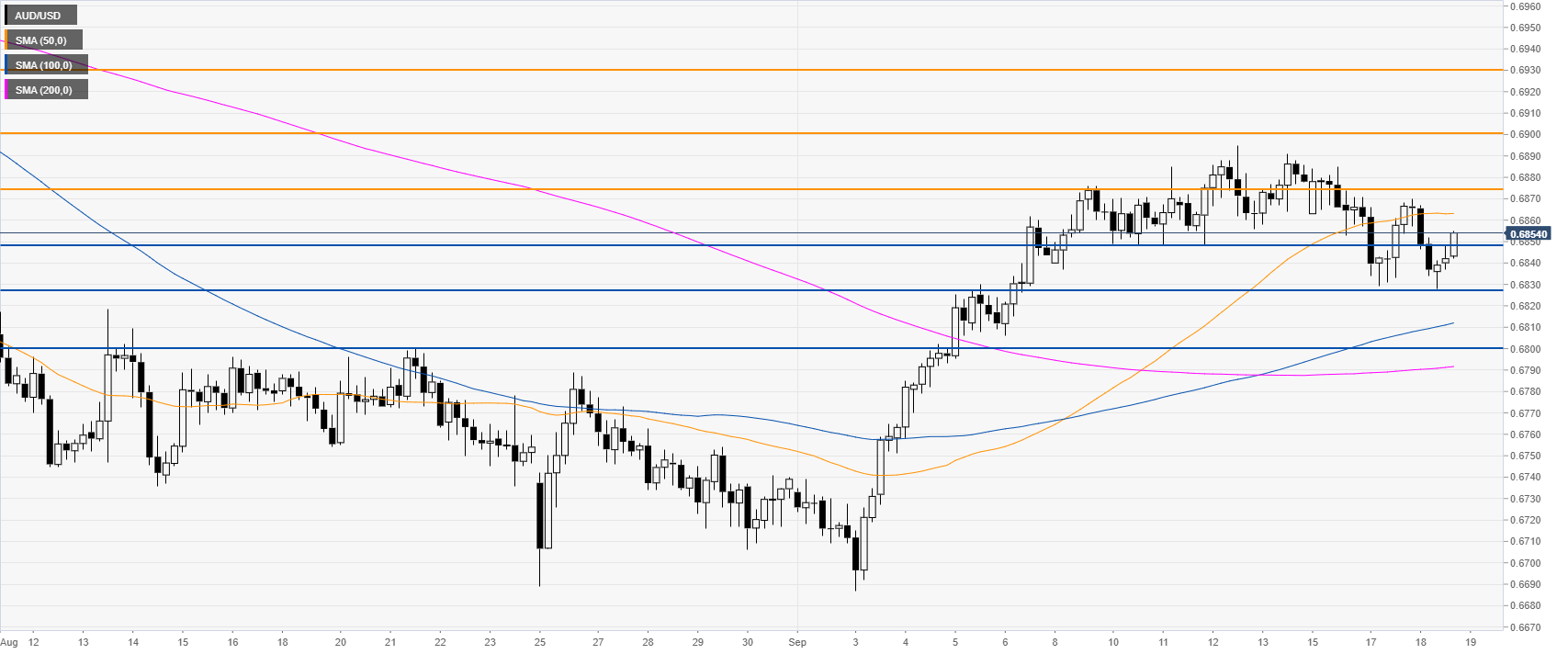

AUD/USD 4-hour chart

After dipping to the 0.6827 support, the Aussie is rebounding and trading above the 100/200 simple moving averages (SMAs), suggesting bullish momentum in the near term. However, the Aussie will need a daily close above the 0.6874 resistance to open the doors towards the 0.6900 and 0.6930 resistance, according to the Technical Confluences Indicator.

The bearish scenario involves sellers breaking below the 0.6827 support and driving the market towards the 0.6800 handle.

Additional key levels