Back

28 Aug 2019

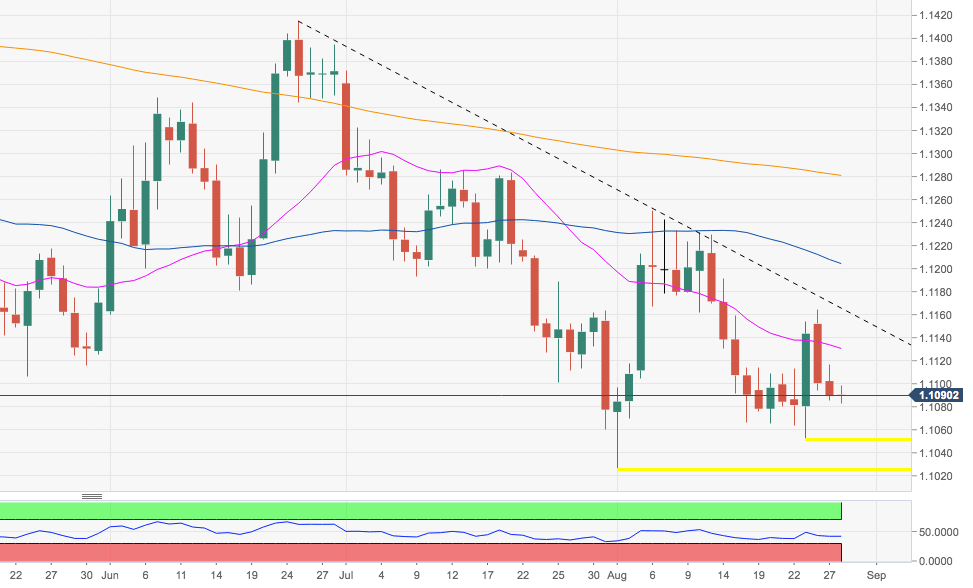

EUR/USD Technical Analysis: Absence of buying interest exposes a potential test of 1.1050 and below

- EUR/USD remains unable to sustain a bull run above the 1.1100 handle for the time being.

- Immediately to the upside emerges the interim hurdle at Monday’s tops around 1.1160 ahead of the Fibo retracement at 1.1186 while the 1.1203/08 band emerges as a more significant resistance. In this area coincide the 55-day and 100-day SMAs.

- If the sellers regain the upper hand, a visit to last week’s low at 1.1051 should be back to the horizon ahead of 2019 lows at 1.1026.

EUR/USD daily chart