Back

20 Nov 2018

WTI Technical Analysis: Slogging it out near the bottom, bidders seeking $57.00

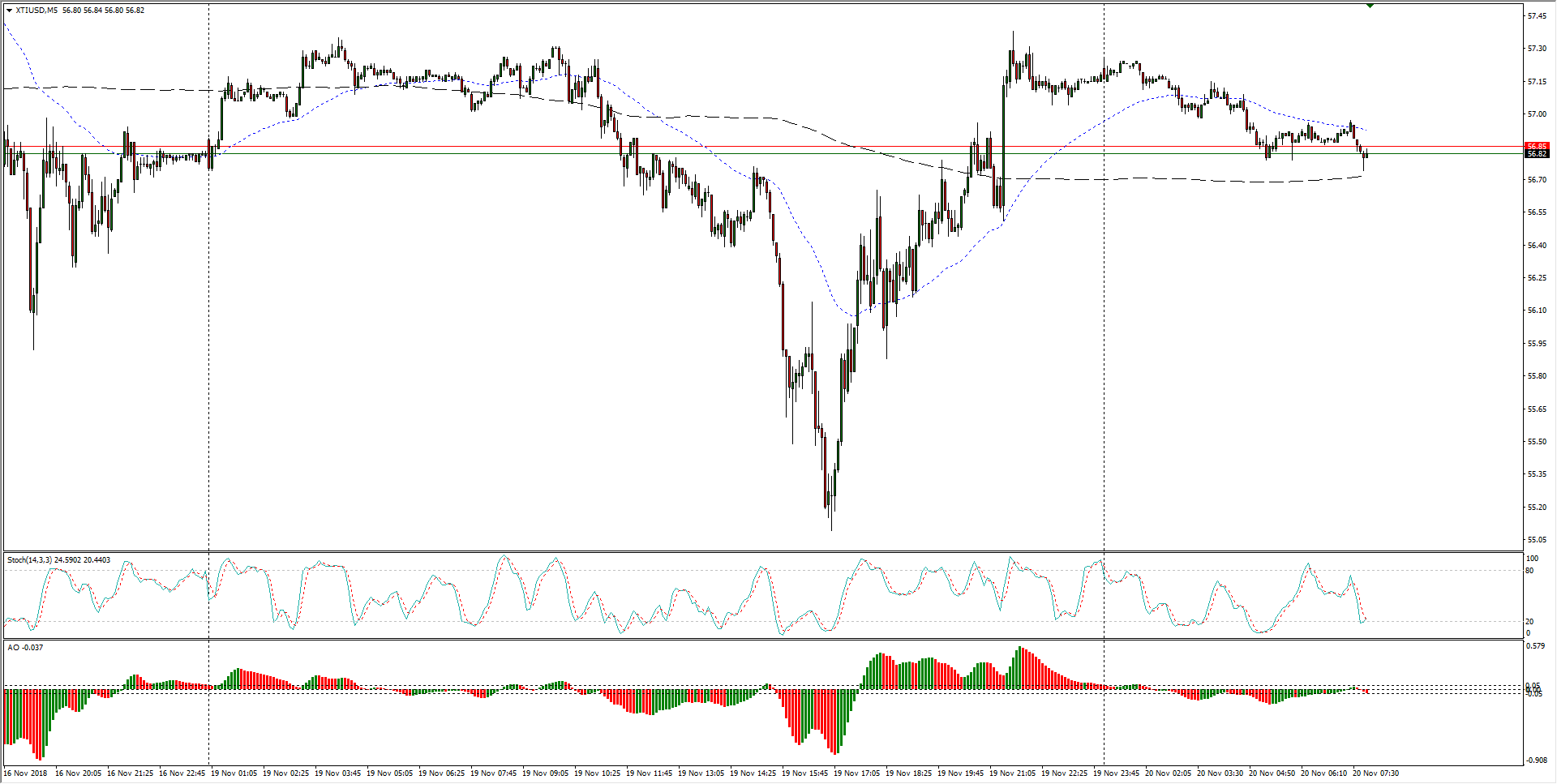

- The last twenty-four hours saw US crude dip into the 55.00 critical level before immediately rebounding to familiar resistance levels near 57.00.

WTI Chart, 5-Minute

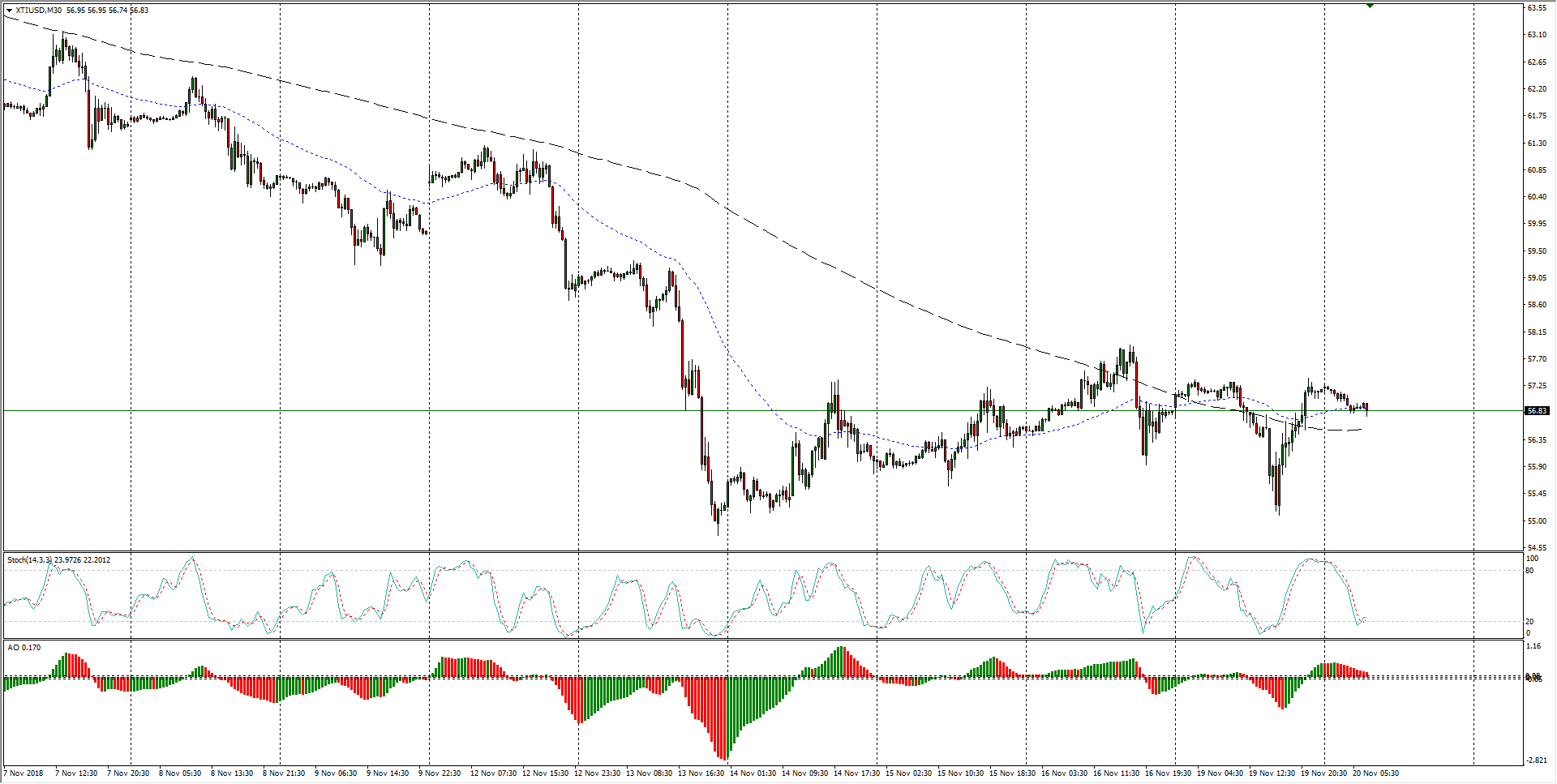

- Despite some shocks to the downside, American crude barrels are holding steadily above the near-term bottom at 54.75 as energies traders recover from several months of headline-fueled shock selling.

WTI Chart, 30-Minute

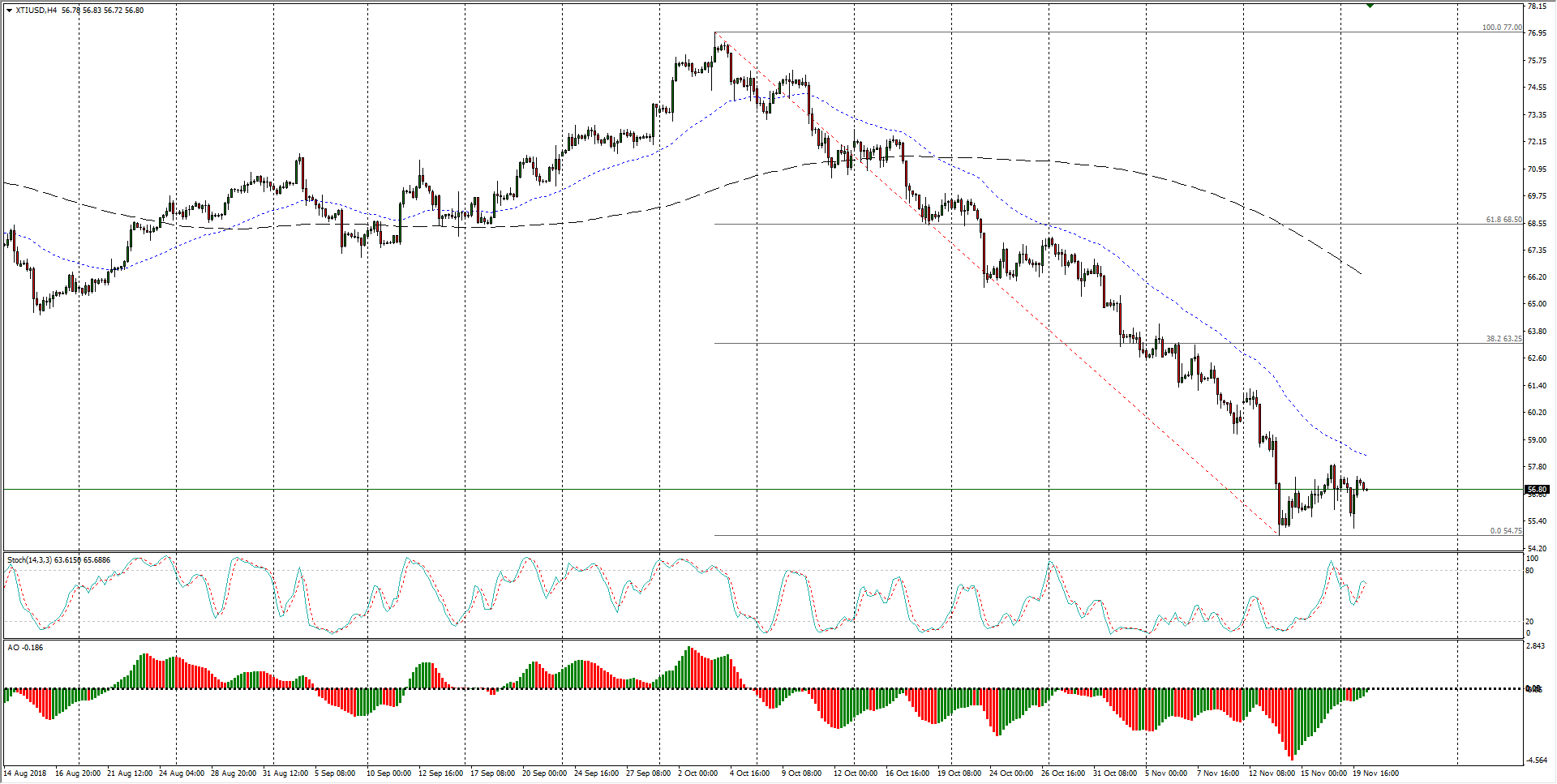

- WTI's six-week decline shows just how far critical energy has declined, and even a straight bounce to the 38.2% Fibo retracement level at 63.25 will still see WTI maintain a bearish stance in the medium-term.

WTI Chart, 4-Hour

WTI

Overview:

Last Price: 56.99

Daily change: -37 pips

Daily change: -0.645%

Daily Open: 57.36

Trends:

Daily SMA20: 61.06

Daily SMA50: 67.43

Daily SMA100: 67.91

Daily SMA200: 68.19

Levels:

Daily High: 57.42

Daily Low: 57.3

Weekly High: 60.93

Weekly Low: 55.21

Monthly High: 76.25

Monthly Low: 64.86

Daily Fibonacci 38.2%: 57.37

Daily Fibonacci 61.8%: 57.35

Daily Pivot Point S1: 57.3

Daily Pivot Point S2: 57.24

Daily Pivot Point S3: 57.18

Daily Pivot Point R1: 57.42

Daily Pivot Point R2: 57.48

Daily Pivot Point R3: 57.54