Back

7 Nov 2018

EUR/USD Technical Analysis: Sticking above 1.1400 for now

- The EUR/USD has seen a notable pickup in volatility over the past twenty-four hours, but directional bias for the pair remains slim heading into Thursday as the Euro's whipping on US mid-term elections leaves both sides of the ask line in the lurch.

- EUR/USD Forecast: 3 drivers to watch after the Dems' win boosts the pair

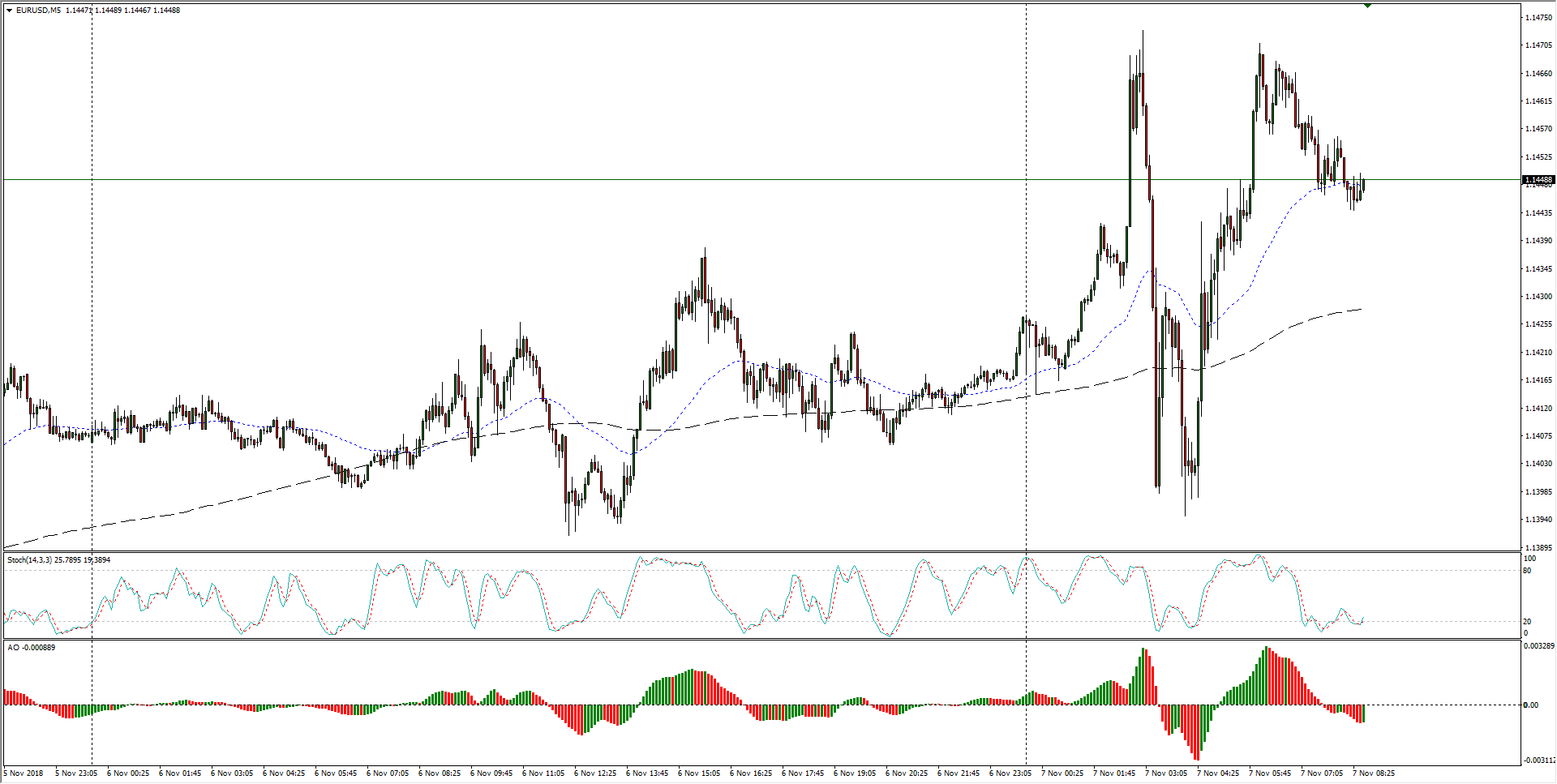

EUR/USD M5

- This week sees the Fiber trying to make a bullish run, but so far has remained capped by last Friday's peaks as overzealous bidders get faded back down to last week's late peaks around 1.1450.

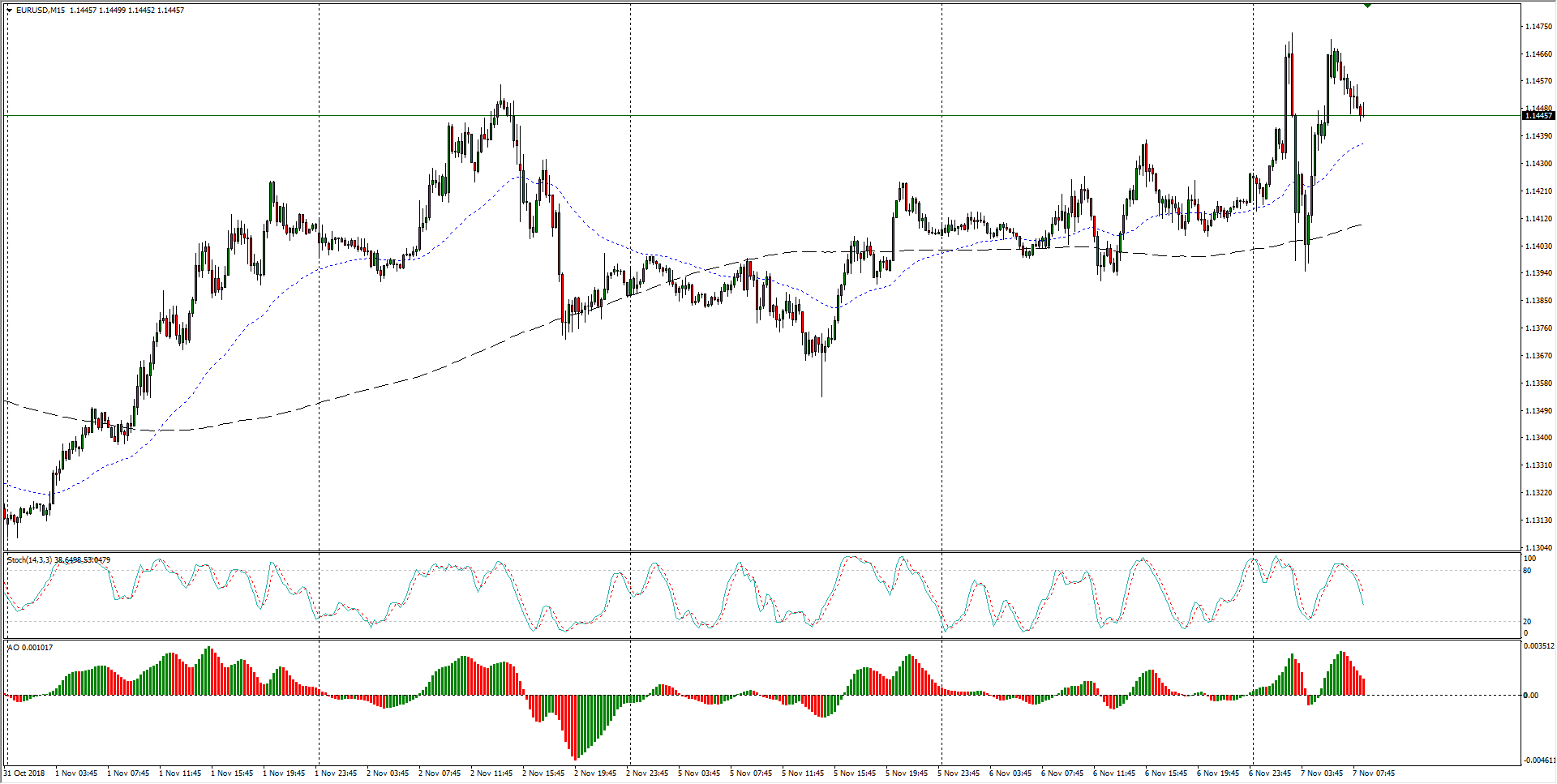

EUR/USD M15

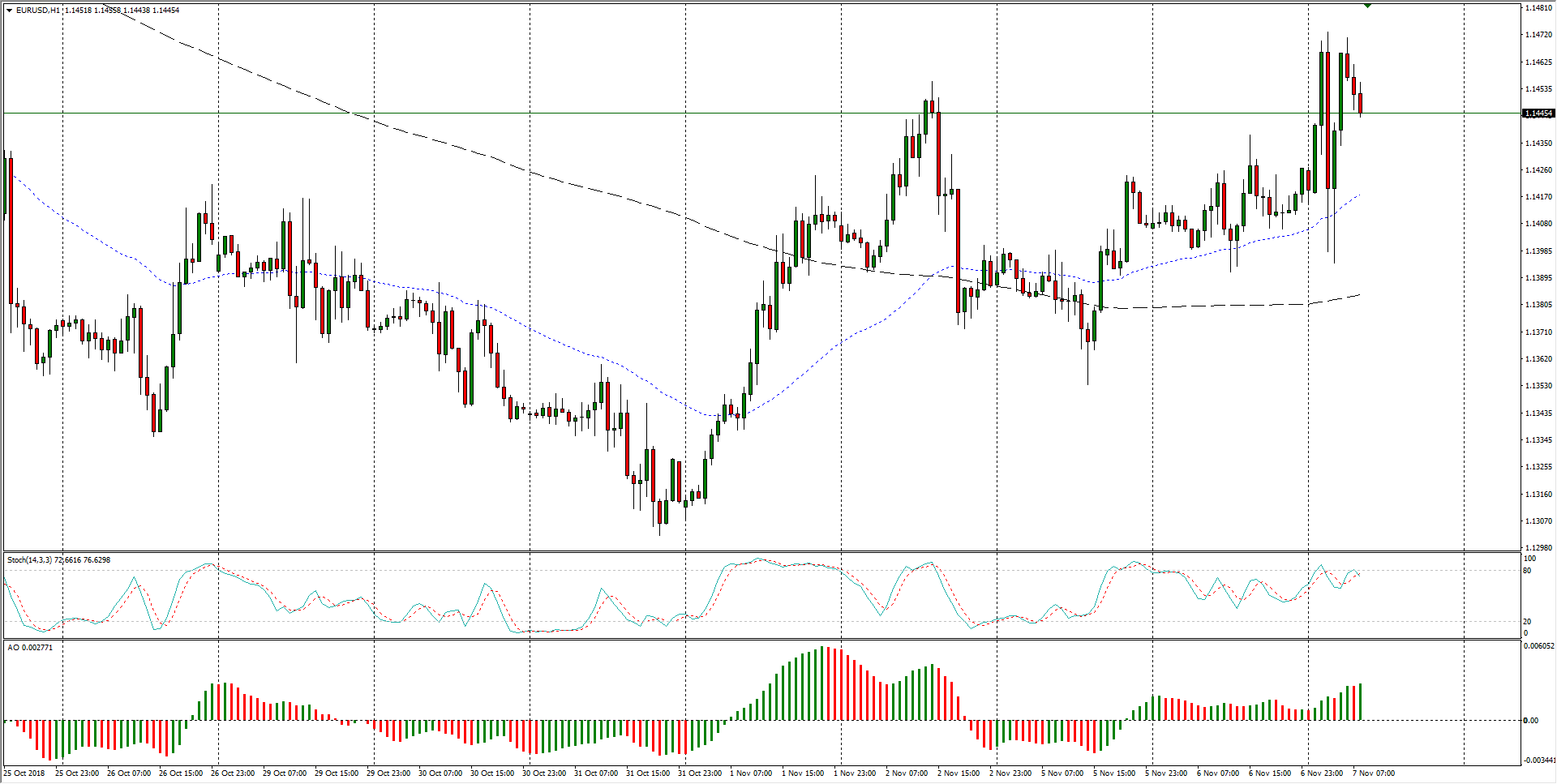

- Looking further out, the Fiber has managed to clear out some room above from the last swing low into the 1.1300 handle, but moves higher are seeing significant pushback, and buyers will have to rely on support from the 200-hour moving average near 1.1385, and a possible dip back below 1.1400 isn't out of the question for the mid-week.

EUR/USD H1

EUR/USD

Overview:

Last Price: 1.1443

Daily change: 25 pips

Daily change: 0.219%

Daily Open: 1.1418

Trends:

Daily SMA20: 1.1453

Daily SMA50: 1.1557

Daily SMA100: 1.1586

Daily SMA200: 1.1857

Levels:

Daily High: 1.1438

Daily Low: 1.1392

Weekly High: 1.1456

Weekly Low: 1.1302

Monthly High: 1.1625

Monthly Low: 1.1302

Daily Fibonacci 38.2%: 1.142

Daily Fibonacci 61.8%: 1.1409

Daily Pivot Point S1: 1.1394

Daily Pivot Point S2: 1.1369

Daily Pivot Point S3: 1.1347

Daily Pivot Point R1: 1.144

Daily Pivot Point R2: 1.1462

Daily Pivot Point R3: 1.1487