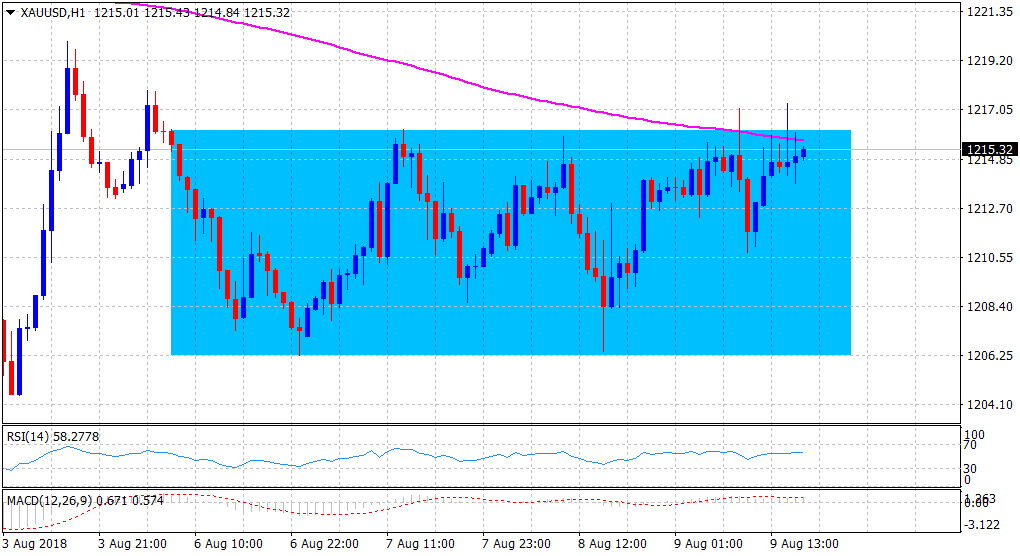

Gold Technical Analysis: Bulls await a convincing break through weekly trading range, 200-hour SMA

• The commodity has been oscillating within a broader trading range since the beginning of this week, forming a rectangular chart pattern on the 1-hourly chart.

• The commodity is testing 200-hour SMA for the first time since July 31 now seems to have raised prospects for a bullish breakout.

• Technical indicators on the mentioned chart are holding with a mild positive bias and further add credence to the near-term bullish outlook.

Gold 1-hourly chart

Spot Rate: $1215.32

Daily High: $1217.31

Daily Low: $1210.79

Trend: Near-term bullish break-out awaited

Resistance

R1: $1218 (weekly high set on Monday)

R2: $1222 (horizontal zone)

R3: $1228 (July 31 swing high)

Support

S1: $1211 (current day swing low)

S2: $1205 (17-month low set last Friday)

S3: $1200 (psychological round figure mark)