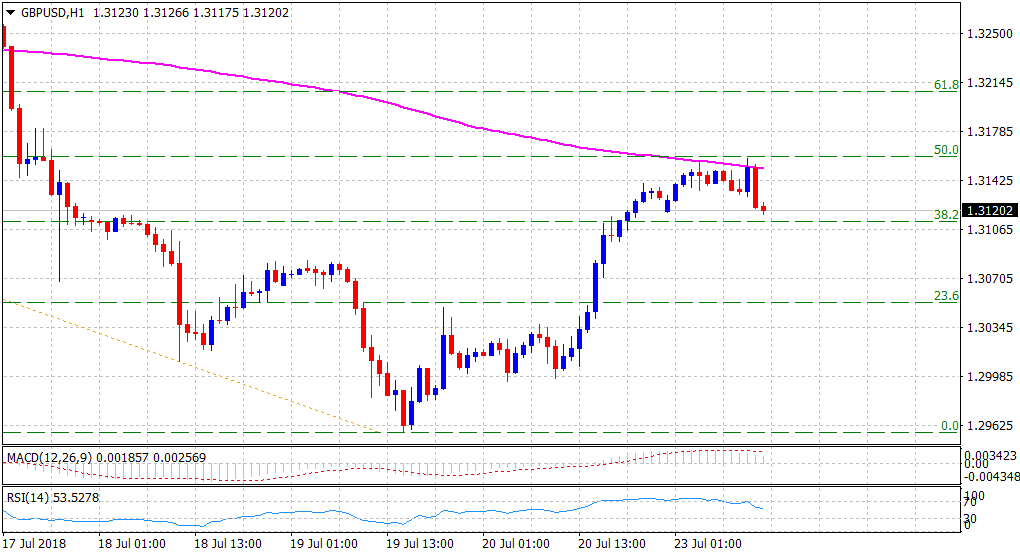

GBP/USD Technical Analysis: Positive momentum fizzles near a confluence resistance

• The pair's goodish recovery move from YTD lows stalls near a confluence resistance, comprising of 200-hour SMA and 50% Fibonacci of the 1.3363-1.2957 recent downfall.

• Meanwhile, technical indicators on the hourly chart continue to hold in positive territory and might attract some dip-buying interest at lower levels.

• However, a convincing break below 1.3080-75 support area would mark the end of a corrective bounce and negate prospects for any further recovery in the near-term.

GBP/USD 1-hourly chart

Spot rate: 1.3120

Daily High: 1.3158

Trend: Neutral

Resistance

R1: 1.3158 (current day swing high)

R2: 1.3186 (20-day SMA)

R3: 1.3200 (round figure mark)

Support

S1: 1.3085 (100-period SMA H1)

S2: 1.3037 (S1 daily pivot-point)

S3: 1.3000 (psychological round figure mark)