USD/MXN unstoppable towards 19.46; 'In Trump we Trust?'

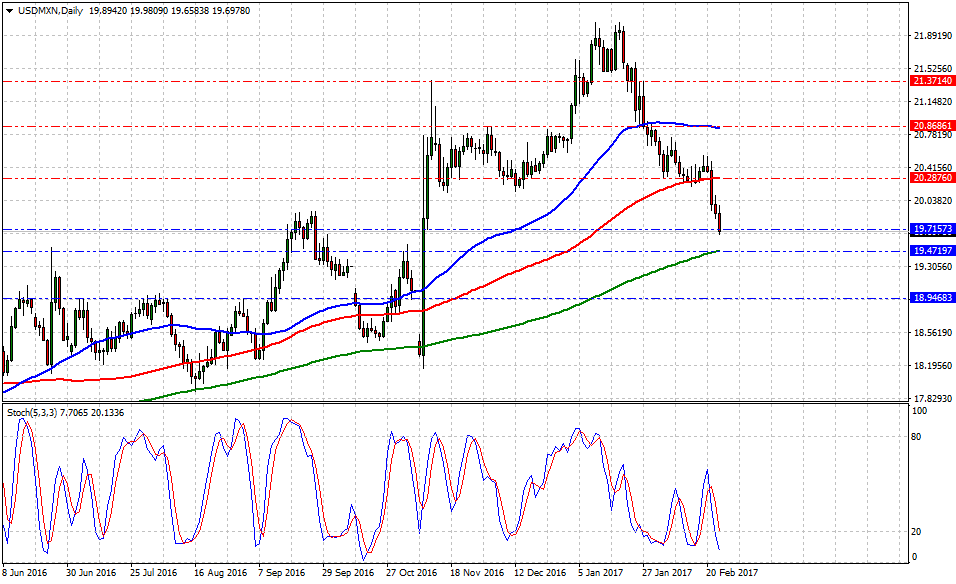

Currently, USD/MXN is trading at 19.67, down -1.18% or (2320)-pips on the day, having posted a daily high at 19.98 and low at 19.65.

Over the last 4-consecutive trading sessions, the American dollar vs. Mexican peso has been under severe selling pressure to accumulate a total exchange rate loss around -3.59% or (7156)-pips; how this happened and how good it could be for the peso in the long-term?

Banxico's military tactic to offer $20 billion in FX hedge was a brilliant manoeuvre to avoid burning the 'rate hike' game and ammo, then commercials and institutions had sufficed reasons aligned to 'shoot down' any single uptick. Evidently, the FOMC minutes delivered another confusing document that felt as a liver-kick to dollar bulls in a moment when one word could have changed the greenback trajectory. And finally, business usual, the US economic docket exhausted the last pound of oxygen from the long-dollar tank when Initial Jobless Claims clocked 'a worse than expected' 244K figure against 241K consensus.

Nevertheless, such actions should not be considered by any means a change in the economic outlook for the North-America region when in fact the odds are still favoring the non-traditional new US administration. There is evidence according to different market sources that Mexico is already 'in talks' to sign new trade deals Asia, Canada, and Europe. The Mexican economy faces a rocky road ahead if NAFTA changes in a way that limits trade with the northern border and somewhat discounted, the boarder-tax, which is not ruled out, can easily boost the US dollar (according to economists) 25% on the spot.

Trump's Agenda delayed or not well-organized has not changed course, if not in late 2017 early 2018 those promises could impact financial markets to shake off those that never thought America had the opportunity to be great again. If Banxico and Mexico fail to align their strategies, there is little to do when the tax cuts and massive spending start in the US; it could mute any trade efforts and as a consequence, the peso not only will be back at 20 but strong the force is to break towards 25 and higher.

On the last minute, 318.9 million (as of 2014) individuals in the US need a better future, therefore, in Trump's best behavior they should all trust.

Mexico: Stronger than expected 4Q2016 and December real GDP figures – Goldman Sachs

Historical data available for traders and investors indicates during the last 8-weeks that USD/MXN, a commodity-linked and exotic currency, had the best trading day at +1.83% (Jan.10) or 3983-pips, and the worst at -2.22% (Jan.25) or (4684)-pips. Furthermore, the US 10yr treasury yields have traded from 2.41% to 2.38%, down -1.03% on the day at 2.38% or -0.0249.

Technical levels to watch

In terms of technical levels, upside barriers are aligned at 20.28 (100-DMA), then at 20.86 (50-DMA) and above that at 21.37 (high Jan.27). While supports are aligned at 19.65 (low Feb.23), later at 19.47 (200-DMA) and below that at 18.93 (low Nov.4). On the other hand, Stochastic Oscillator (5,3,3) seems to navigate in the oversold territory, but 'extreme attention' over US Treasuries to avoid a market trap. Therefore, there is evidence to expect more Mexican Peso gains in the near term.

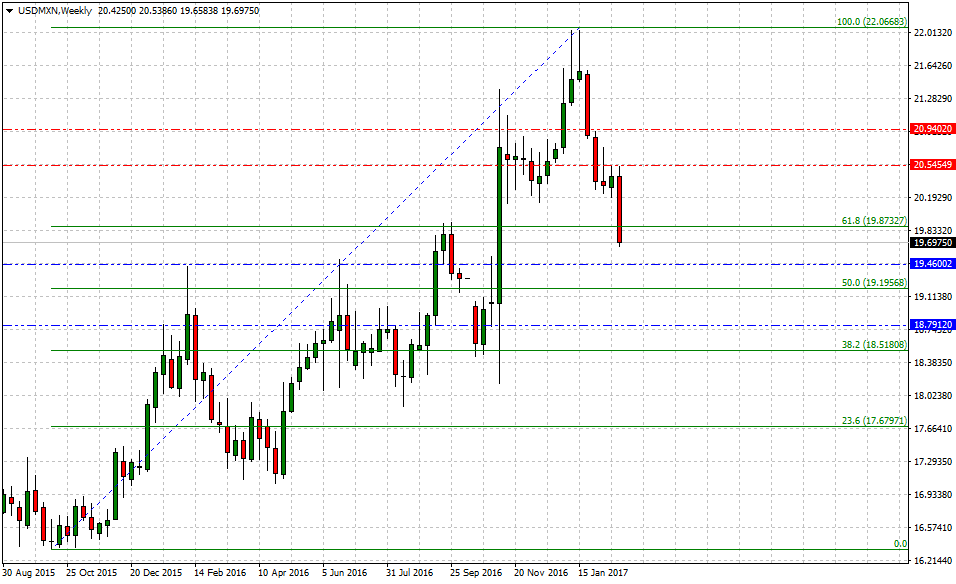

On the medium-term view, if 22.03 (high Jan.15) is in fact, the top during the first semester in 2017, then traders and investors would have allocated risk around the following support levels: 19.46 (low Sep.18), then at 19.19 (short-term 50% Fib) and finally below that at 18.51 (short-term 38.2% Fib). On the other hand, upside barriers are aligned at 19.87 (short-term 61.8% Fib), later at 20.54 (high Feb.12) and above that at 20.92 (high Jan.29).

USD/MXN drifting lower towards 200-DMA; Banxico's auction 'fixes' peso not Mexico